As part of FIA’s ESG Policy, the company has embedded a set of ESG Principles into its policy and procedural framework for responsible investment. ESG stands for environmental, social, and governance, and is the foundation of a concept known as responsible investment whereby ESG factors are incorporated into investment decisions and active ownership. This Q&A with Director of Sustainability and ESG, MaryKate Bullen, explores why FIA created the principles and how they support FIA in meeting our clients’ needs for sustainable investment practices and outcomes.

What are the ESG Principles?

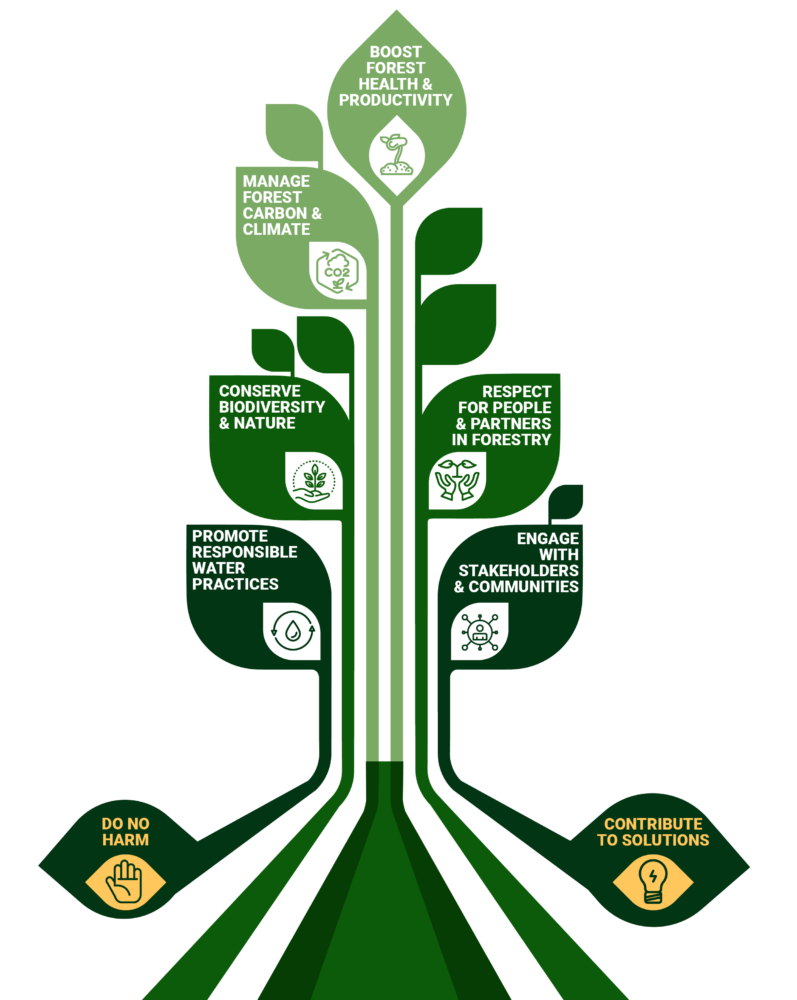

The ESG Principles have two components that work together to help FIA manage our impact on the environment and society. We established two foundational tenets: (1) Do No Harm and (2) Contribute to Solutions. These complementary tenets address facets of both risk and opportunity, and they underpin six thematic principles. The thematic principles are action-oriented, with each one addressing FIA’s responsibility and aspiration in managing a material ESG issue. The tree schematic below depicts how the tenets underpin the risk management and impact opportunities that come from thematic principles.

Why do we need ESG Principles and how were they developed?

The ESG Principles provide a foundation for our approach to the ESG challenges and opportunities we see across the forestry asset class. While there are many regional and international efforts to codify principles or objectives of responsible investing, FIA wanted to ensure we focused on salient ESG issues in the investments we manage. While the ESG Principles launched in 2022, they come from our company’s history of managing material environmental and social factors as well as the expertise and beliefs of the FIA team regarding key sustainability issues in the forest sector today.

We created the Principles via our ESG Committee with input from a cross-company group of FIA employees who helped undertake a materiality assessment in 2021. We found that identifying the material issues, what actions we take, and why they are important to FIA and stakeholders helped us articulate our view on how responsible forest management can contribute meaningfully to increasing demands for sustainable investments as well as addressing important global challenges like climate change, biodiversity loss, and the need for sustainable development.

How does FIA use the ESG Principles?

The ESG Principles are a core part of how we operate as sustainable and responsible investors. The FIA ESG Principles are designed to foster consistent consideration of material ESG factors within all phases of our investment process, while also describing how we aim to manage toward positive net impact. The ESG Principles are embedded into the ESG Policy, which applies to all investments we manage and is communicated to our local operating partners and key contractors who execute forestry operations. This is critically important so that we have clear expectations and alignment for the on-the-ground forestry activities that take place, which are where many material ESG issues can occur. In addition, FIA applies the ESG Principles to support our further development of investment strategies and initiatives that promote environmental and social benefits alongside commercial forest investments.

What’s next for FIA in terms of ESG?

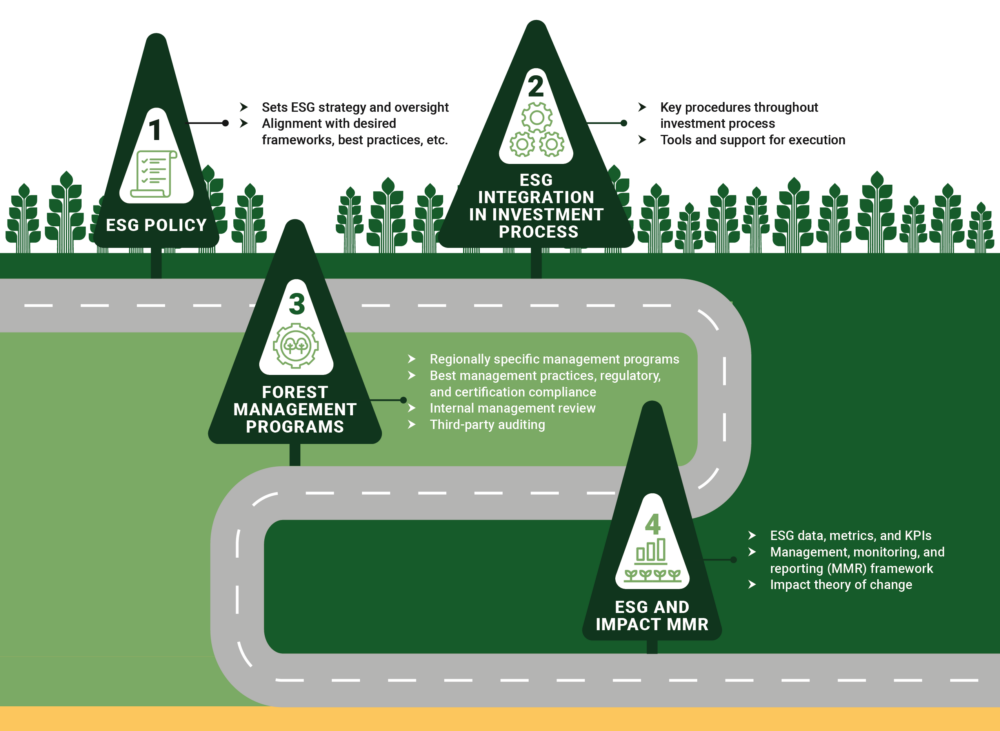

We are continuing to build out our ESG and Impact Framework, which includes the ESG Policy, Forest Management Programs, and ESG data and performance management. We want our approach to ESG to be rooted in the issues that are most important for investors while providing the tools and data to support consistently high standards of responsibility. One of the key steps in this is building out the systems and data framework to enable a strong, intentional approach to impact management in mandates where appropriate.

Our intent is to be authentic to FIA’s own journey and approach in ESG, which we are evolving together with clients and in response to changes and opportunities in the market. We have found exciting success in working directly with investors to understand their ESG priorities and reviewing the market and operational contexts to develop ESG-driven investment strategies, such as targeting the delivery of climate benefits at scale.

The graphic below depicts components of our ESG and Impact Framework and the roadmap we are following to formalize and continually improve our ESG capabilities. We hope these ESG Principles prove to be an important north star for us – and ideally for our clients as they consider what forestry means in their own portfolios – as we continue to navigate our performance and progress in sustainable investment.

If you have questions or feedback about FIA’s ESG Principles or our Sustainability Programs, visit the Contact Us page to submit your inquiry.