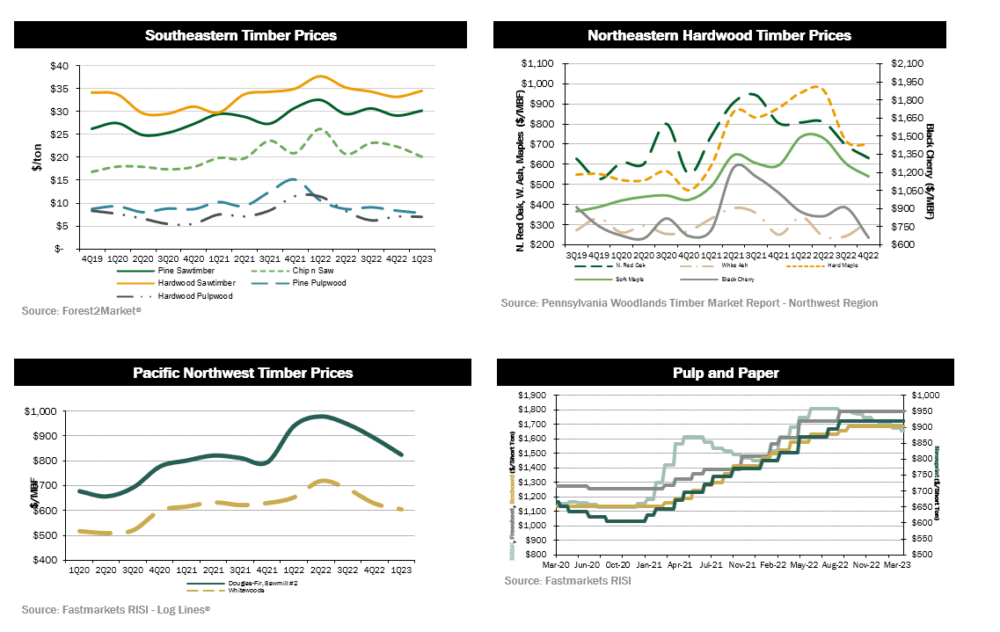

SUMMARY UPDATE — Log markets in the Pacific Northwest continued to soften due to high inventory. In the U.S. South, demand for all pulpwood and chip-n-saw products decreased in the first quarter, however, hardwood and pine sawtimber saw a modest increase. Hardwood markets in the Northeast increased for most species, other than maples, due to increased demand and lack of stumpage inventory. Lumber and panel prices leveled off after softening over the last year.

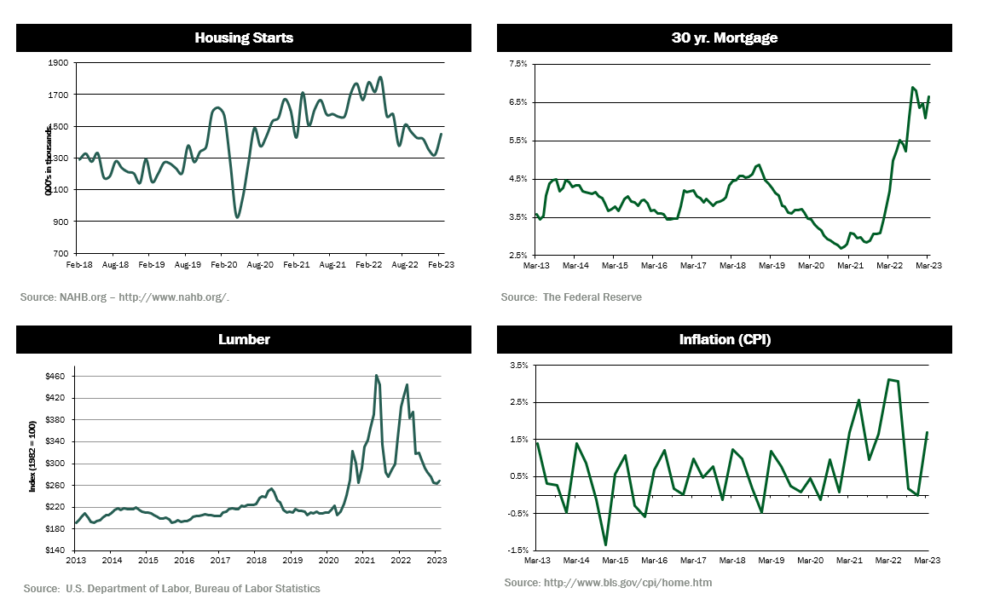

Mortgage rates continued to be volatile, ending around 6% for a 30-year, fixed rate. Nontheless, mortgage rates continue to cause affordability issues and apply downward pressure on housing demand. Housing starts saw a 10% increase from fourth quarter levels but are down about 18% year-over-year.

TIMBERLAND MARKETS — The headline transaction of the first quarter was Nuveen’s announcement that it had acquired 47,750 acres of timberland in Washington and Oregon from Green Crow for approximately $230 million. Elsewhere in the Pacific Northwest, Molpus sold 18,000 acres in Idaho to the Idaho state government for a reported price of $50.4 million. In Washington, Ecotrust purchased 11,000 acres from Rayonier for $30.6 million. In the South, Manulife announced its acquisition of 55,000 acres in South Carolina from Sonoco for $72 million. Finally, Salm Schulenburg purchased 12,600 acres in Alabama and Mississippi from Weyerhaeuser for $25.4 million. Several other offerings are expected to close in the second quarter, setting up a busy start to 2023.

![]()

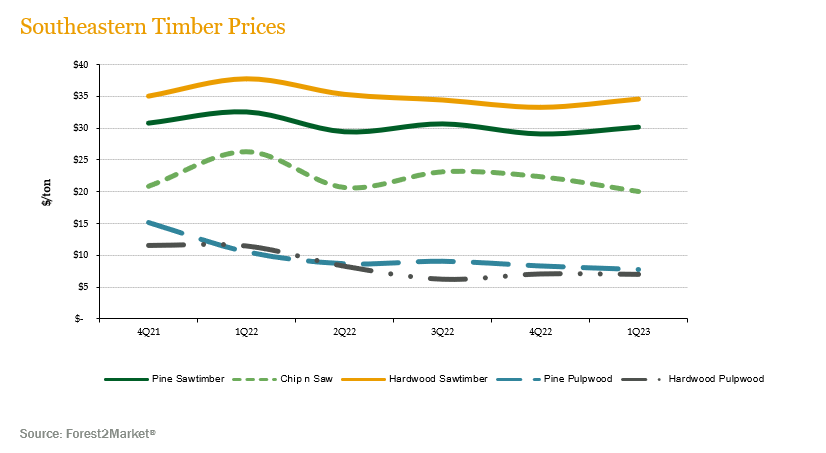

SOUTHEASTERN — Forest2Market reports an increase in pricing for pine and hardwood sawtimber products in the U.S. South during the first quarter; however, prices for all other major pine and hardwood products fell. Pine sawtimber increased 3.6% over the quarter but fell 7.2% year-over-year. Pine chip-n-saw prices fell 10.2% during the quarter and 23.3% for the year. Pine pulpwood prices fell 6.7% and ended the quarter 26.4% below last year’s level. Hardwood pulpwood fell about 1.0% during the first quarter, continuing the trend seen throughout the year and finishing 39.1% below last year’s level. Hardwood sawtimber experienced a modest increase of 3.9% and fell 8.5% for the year.

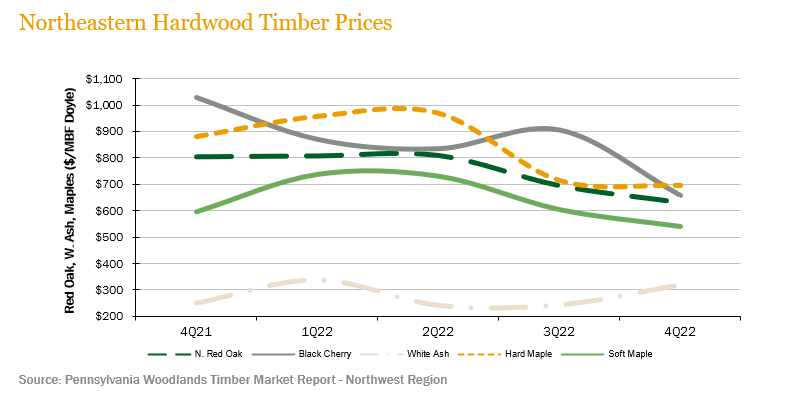

NORTHERN HARDWOODS — Demand varied across the key species in the Pennsylvania wood market. According to the Pennsylvania Woodlands Timber Market Report, white ash prices jumped about 31.3% during the fourth quarter (the most recent publicly reported pricing) and ended the quarter 27.7% above year-ago levels. Soft maple prices fell 10.7%, and in conjunction, hard maple and red oak prices decreased 2.6% and 9.3%, respectively, over the quarter. In addition, black cherry prices fell 27.5%.

Hardwood lumber and log demand began to increase around the middle of the first quarter. There was moderately strong market interest in almost all species, including red oak and black cherry. Hard and soft maple demand remains subdued, but pricing seems to have reached a stable floor. This uptick in demand was driven by several factors, including China re-opening, poor winter logging conditions, lack of stumpage on the market, and domestic users re-stocking depleted inventories. It remains to be seen how long this market upturn will last given that most of the current, frenzied demand seems to be driven by supply replenishment. Hardwood pulpwood demand continued to erode during the first quarter.

Hardwood markets in Wisconsin remained lackluster throughout the first quarter. Hard maple, yellow birch, and basswood sawlog pricing was fairly stable as mills slowly built-up log inventory for the spring break-up period. Veneer log demand was strong as is typically the case during this time of the year, while boltwood demand remained depressed due to lower flooring demand. Hardwood pulpwood markets weakened as mills quickly built-up ample inventories for spring break-up.

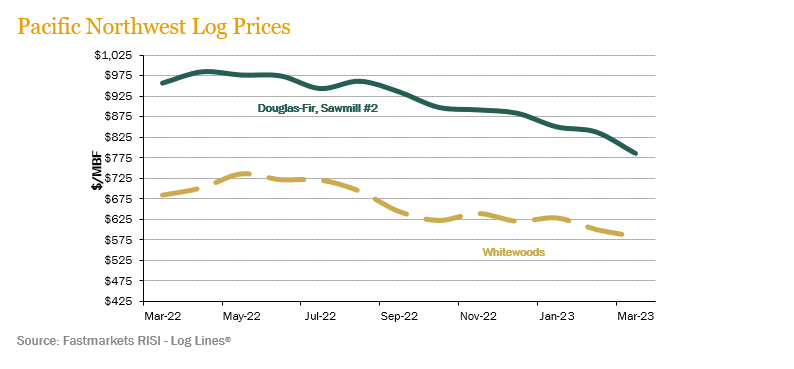

PACIFIC NORTHWEST — Pacific Northwest pricing continued to soften for the third consecutive quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs decreased 7.5% over the quarter and 12.4% year-over-year. Whitewoods’ (i.e., true firs and hemlock) average delivered log prices decreased 3.7% over the fourth quarter and 7.4% year-over-year.

Log markets dropped off over the first quarter. Log inventories remained high at most domestic sawmills, and prices dropped slightly but remain comparable to those seen in the fourth quarter of 2022. Domestic prices for Douglas-fir are holding at upwards of $800/MBF, with prices reaching to nearly $850/MBF in select log markets. Export demand from China slightly softened with pricing averaging around $700/MBF for Douglas-fir and upwards of $625 for whitewoods. Exports to Japan have fallen but remain competitive at $800/MBF relative to domestic pricing.

![]()

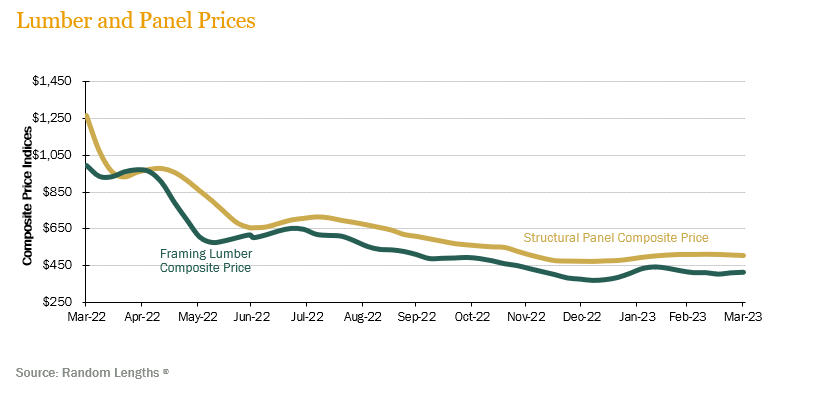

LUMBER AND PANELS — Lumber and panel prices generally leveled out during the quarter, following a softening in pricing over the last few quarters. The Random Lengths® Framing Lumber Composite Price ended the first quarter up 9.7% but down 58.0% year-over-year. Structural panel prices rose 6.6% but ended the quarter down 60.2% from last year.

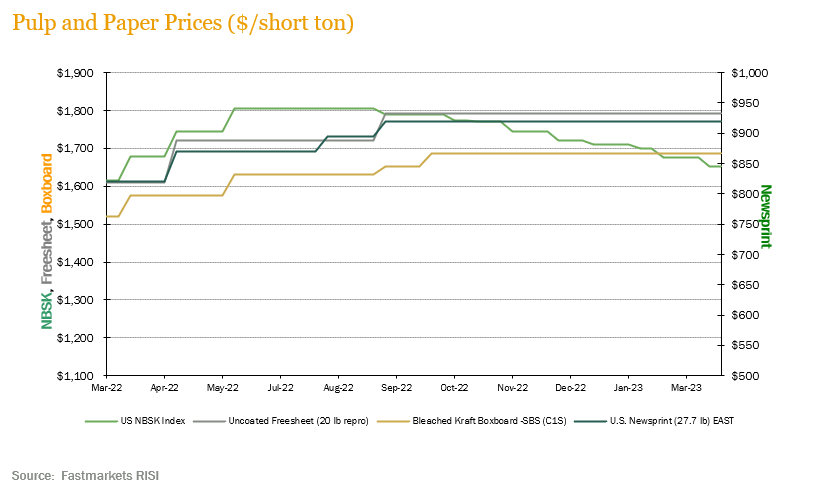

PULP AND PAPER — Over the fourth quarter, demand for paper and paper products remained relatively flat, however, pulp prices fell slightly. The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased -3.9% but ended the quarter 2.4% above year-ago levels. U.S. Newsprint (27.7 lb.) prices had no noticable change over the quarter, ending 11.3% above last year’s level. Freesheet prices also remained flat during the quarter, ending 21.3% above last year’s level, Boxboard prices remained flat as well, ending 10.9% above last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the first quarter was Manulife’s announcement that it had purchased 55,000 acres in South Carolina from Sonoco for $72 million. The majority of the property is comprised of natural hardwood stands, helping explain the relatively low $1,300/acre price tag. In northern Alabama and Mississippi, Weyerhaeuser sold 12,600 acres to Salm Schulenburg for a reported price of $25.4 million.

The Pacific Northwest market was very active in the first quarter, with three separate closings. The largest deal was Nuveen’s announcement that it purchased 47,750 acres in Washington and Oregon from Green Crow for approximately $230 million. In Idaho, Molpus completed its sale of 18,000 acres to the Idaho state government for $50.4 million. Finally, Ecotrust completed its purchase of 11,000 acres in Washington from Rayonier for $30.6 million.

TRANSACTIONS IN PROGRESS — There are a several offerings on the market expected to close in the second quarter and another handful with offers due before June. While market activity has been robust early in 2023, it will be hard to top the $5 billion transaction total posted in 2022.

![]()

Global markets continue to show positive signs due to the U.S. Federal Reserve’s less restrictive monetary policy and China’s reopening after removing its restrictive zero Covid policy. During March, China’s National People’s Congress announced a GDP growth target of 5%, after growing only 3% during 2022.

According to the most recent Timber Market Survey (December 2022, latest data available), timber markets in Australia remained stable with supply of softwood products generally available, although slightly impacted by regional floods. A predicted softening in the housing construction market for the next two years will provide headwinds to softwood timber consumption. According to the Australian Bureau of Statistics, there was a 23% drop month-over-month during January 2023 in approvals for new detached housing. As a result, prices for structural softwood products during the last quarter of 2022 (latest data available) slightly contracted. In New Zealand, export log markets show positive signs, with a 14% increase in at wharf gate log prices during March, in tandem with increased demand from China. Demand from China is still below historic levels.

CHILE — During February 2023 (latest data available), the Chilean economy registered a 0.5% contraction year-over-year, mainly due to a drop in trade and the manufacturing industry. Inflation, although beginning to show signs of cooling, continues to be stubbornly high at 11.1% annual variation rate of the consumer price index (CPI) as of March. As a result, Chile’s Central Bank voted unanimously to keep the monetary policy interest rate at 11.25%. During the year, Chile’s economy is expected to show modest but stable growth, mainly driven by increased appetite for Chilean exports (such as copper, Chile’s main export) by China as it emerges from its restrictive zero covid policy and drives better demand prospects.

On the political front, early in March, Chile’s congress generally rejected a controversial tax reform presented by the government of President Gabriel Boric during 2022. The rejected tax reform sought to increase tax collection through various modifications to the country’s tax system, including an increase in personal tax rates, the creation of a wealth tax, and the incorporation of a tax on retained earnings of investment companies, among other modifications. With this rejection, President Boric’s government would be unable to present another tax reform on the same matters for a period of one year.

The Chilean forestry industry began this year with more modest figures compared to a robust 2022. The primary impact was lower demand for forest product exports by the United States, the second largest destination market after China. During February, the sector’s shipments totaled $383.7 million USD, a drop of 13.4% compared to February 2022 and a 28.3% drop month-over-month. This drop was driven mainly by lower demand in the U.S. for products such as moldings, sawnwood, pulp, and other forest products. Conversely, other products recorded growth and higher sale prices such as chemical pulp, multilayer cardboard, and Eucalyptus nitens wood chips. China and the U.S. continue to be Chile’s main export destinations with 32.1% and 21.2% market share, respectively, followed by South Korea, Mexico and Japan.

BRAZIL — During the first 100 days since returning to the presidency of Brazil, Luiz Inacio Lula da Silva (“Lula”) has had mixed results. He has been able to normalize international relations which had sharply deteriorated for Brazil under previous leadership, but he will still need to achieve the right balance of international relationships between western powers and those in China and Russia. Lula must also balance government spending to deliver on the social programs and campaign promises that won him reelection and a healthy fiscal environment. During their first quarter meeting, the COPOM (Brazil’s Central Bank Monetary Policy Committee) maintained interest rates at 13.75% and signaled intention of keeping the rate at this level. Brazilian inflation for the year is expected to be in the 6% range, and more importantly, energy, fertilizer, and other commodity prices have returned to normal levels after a highly volatile 2022.

In the Brazilian forestry sector, pulp production from January to December 2022 (latest data available) reached 24.97 million tons, an increase of 10.9% versus the same period a year earlier and the highest volume produced in the last ten years. Exports of market pulp from Brazil during this same period also rose to 19.15 million tons, an increase of 22.1% versus the same period a year earlier. Export volume (m3) of wood panels during 2022 advanced by 14.8% year-over-year. Both Suzano and Klabin, two of Brazil’s most important pulp producers, registered important advances in their industrial expansion projects: a brand-new pulp mill rising in Matto Grosso do Sul for Suzano and an important expansion for Klabin in their existing facility in Paraná.

![]()

HOUSING — February housing starts came in at 1.4 million units, a near 10% increase from January estimates, though still 18.4% below the February 2022 total of 1.7 million units.

MORTGAGE RATES — Rates have been highly volatile over the first quarter, with the average 30-year fixed-rate mortgage ending at around 6%.

JOBS — The U.S. created an estimated 311,000 jobs in February and 504,000 in January. Both easily surpassed expectations, creating pressure for the Fed to continue to raise rates.

CONSUMER CONFIDENCE — The Consumer Confidence Index increased to 104.2 in March from an upwardly revised reading of 103.4 the month before. A reading above 100 indicates optimism.

INFLATION — The consumer price index rose 0.4% in February and 6% from a year ago, in line with market expectations. A drop in energy prices helped keep inflation in check, while shelter costs increased sharply.

TRADE DEFICIT — The U.S. trade deficit widened more than expected in February as exports of goods declined, suggesting that trade could drag on economic growth in the first quarter. The trade deficit increased 2.7% to $70.5 billion.

INTEREST RATES — In late March, the Fed increased its benchmark federal funds rate to a target range between 4.75%-5%. Median estimates project the fed funds rate to hit 5.1% this year, but to then decline to 4.3% as of the end of 2024, and 3.1% as of the end of 2025.

OIL PRICES — Oil traded in a range of $70 to $80 a barrel over the first quarter.

U.S. DOLLAR — The U.S. dollar index traded in a range of between 101 and 105 for the first quarter, hitting highs not seen in the last 20 years.

![]()