SUMMARY UPDATE — As we enter more deeply in 2025, global timberland and timber markets are navigating a complex mix of stabilizing economic fundamentals and emerging policy-driven uncertainty. In the U.S., regional variability and evolving demand continue to shape market conditions. The return of the Trump administration brings a renewed focus on domestic resource development, with potential regulatory and trade shifts on the horizon.

Meanwhile, the broader economic outlook remains unsettled. While indicators like housing, inflation, and interest rates show signs of stabilization, uncertainty around newly proposed tariffs clouds the path forward. Given wood use’s strong correlation with economic activity, FIA continues to monitor developments closely and adjust portfolio strategies as needed.

In timber markets, prices for key products in the South rose across the quarter, and prices in the Pacific Northwest had a strong recovery across the same time period. Hardwood markets in the Northeast varied with white ash prices gaining traction. Lumber and panel experienced softening price movement throughout the quarter. Mortgage rates fell from a peak above 7.0% at the beginning of the year to 6.65% at the close of the quarter. Housing starts and building permits both grew more than 11.0% across the first quarter.

TIMBERLAND MARKETS — The biggest news of the first quarter was the announced completion of Rayonier’s sale of its New Zealand timberlands, known as Mataiki Forests, to The Rohatyn Group (TRG) for a reported price of $710 million (approximately NZD 1.2 billion). TRG acquired Rayonier’s full share of its New Zealand joint venture (77%), implying a full asset valuation of approximately $922 million for the 287,000-acre estate.

Forest Investment Associates (FIA) was active in dispositions, with the completion sale of 11,000 acres in Texas to Resource Management Services. FIA also had several other packages active in potential dispositions over the quarter.

In Washington state, Chinook Forest Partners closed on its acquisition of 6,300 acres from Weyerhaeuser for a reported price of $22.1 million. Transaction details on several deals from 2024 also trickled in throughout the first quarter. A flurry of offerings also hit the market during the first quarter of 2025, with many taking bids at the end of the quarter. Investors continue to monitor these pending transactions, while a handful of other offerings are taking bids in the second quarter. Transaction volume is off to a fast start for 2025.

![]()

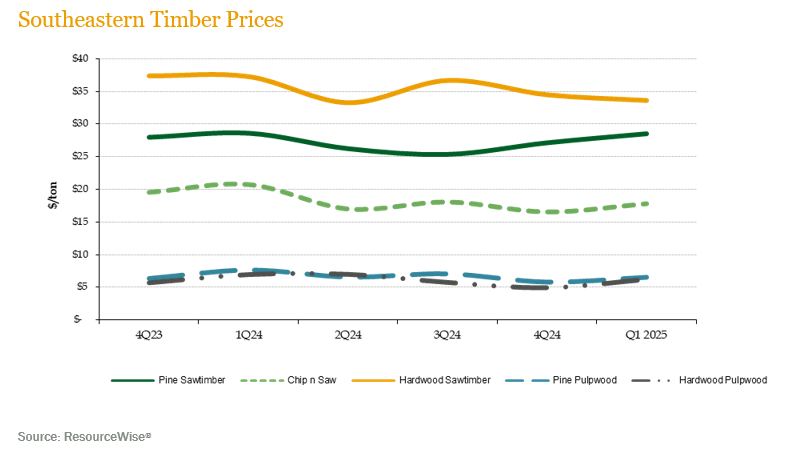

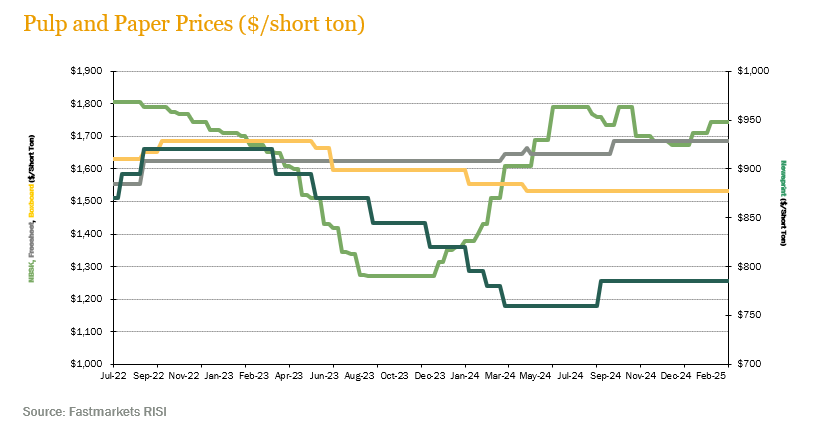

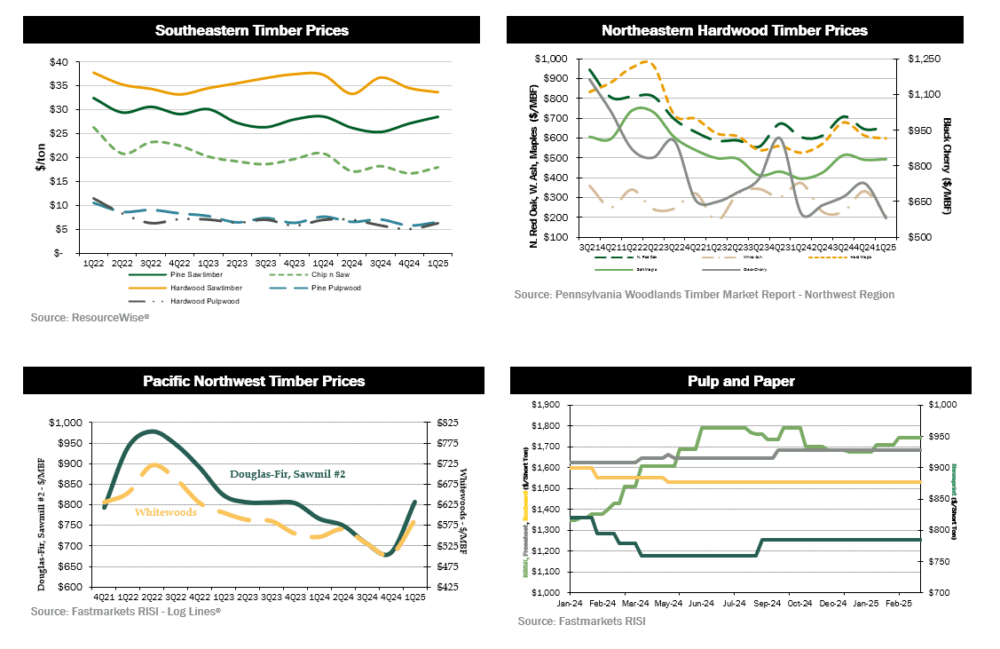

SOUTHEASTERN — Forest2Market reports that pricing for pine products rose in the U.S. South during the first quarter despite being softer than year-over-year prices. Pine sawtimber prices gained 5.2% across the quarter despite being down 0.3% year-over-year. Pine chip-n-saw and pine pulpwood prices are up 7.6% and 13.0% on the quarter while being down 14.1% and 14.6% from last year’s prices, respectively. Hardwood pulpwood increased 25.35% during the quarter and ended 10.4% below last year’s level. Hardwood sawtimber fell 2.5% during the quarter and is down 9.8% for the year.

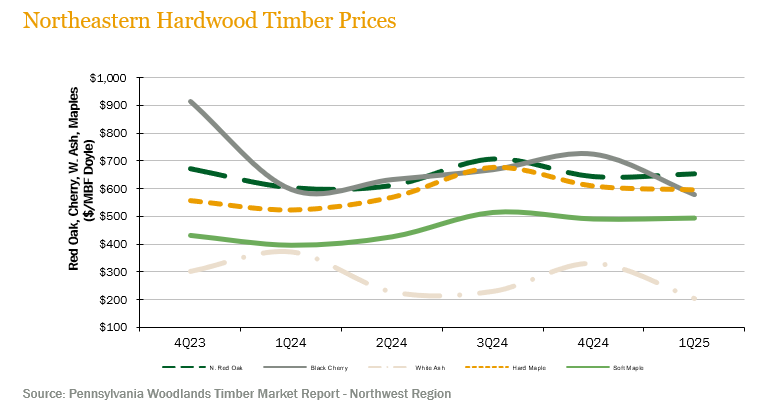

NORTHERN HARDWOODS — Demand remained low across the key species in the Pennsylvania wood market across the last quarter. According to the Pennsylvania Woodlands Timber Market Report, as of the end of March, price responses varied throughout the quarter. Red oak prices rose 1.6% over the quarter and are up 8.4% from last year’s prices. Soft maple prices increased 0.7% over the quarter and 24.9% over last year’s prices. Hard Maple prices fell 2.2% over the quarter while prices rose 13.9% over the past year. Black cherry and white ash prices fell notably over the quarter with prices down 20.1% and 37.9% and year over year prices are down 3.1% and 44.7% respectively.

Hardwood markets remained lackluster throughout the first quarter. Weak home construction numbers, high mortgage rates, and economic uncertainty persisted throughout the duration of the first quarter which impacted demand. Domestic lumber and log demand was somewhat stable despite much lower volume levels, forcing sawmills to adjust production to reduce excess inventory. Export demand was stable through much of the first quarter, though ongoing tariff negotiations dampened markets towards the end of the quarter. White oak, red oak, and hard maple demand were resilient while red maple interest was slightly lower. However, black cherry has continued to be an unfavorable species in the market. Low grade lumber products also continue to struggle from previous quarters. Pulpwood markets saw a slight increase in the latter part of the quarter, however this is a seasonal increase that is expected to be short lived.

In the lake states, hardwood markets were relatively steady across the first quarter. Hard maple and ash sawlog demand was stable compared to previous quarters. Birch sawlog demand and pricing were slightly softer while basswood demand was poor. Veneer log markets performed well with hard maple, ash, and birch logs as the most desirable products. Interest in hard maple bolts was good, but pricing decreased primarily due to lower demand for flooring for new and existing homes. Pulpwood markets saw slight improvements during the quarter, but was most likely due to mills trying to build inventory ahead of seasonal logging lows that occur during spring due to weather and operability of sites for logging and transport.

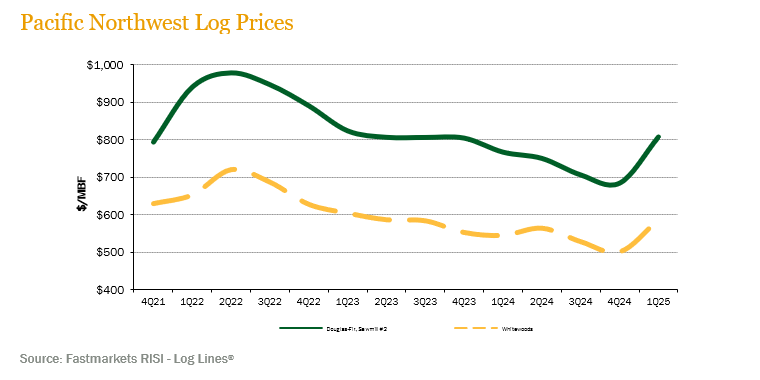

PACIFIC NORTHWEST — Pacific Northwest pricing had strong recovery across the first quarter. Log Lines® reported that average delivered prices for Douglas fir #2 logs increased 18.1% quarter-over-quarter and 5.3% year-over-year. Whitewoods (i.e., true firs and hemlock) average delivered log prices rose 16.9% during the quarter and 7.6% year-over-year.

Log demand rose throughout the quarter in certain markets. Log prices increased from fourth quarter averages with Douglas fir sawlog prices averaging between $800 and $850/MBF in domestic markets. The Willamette Valley of Oregon continues to be a bright spot where purchasers are willing to pay to keep key mills supplied. In this region, sawlog prices have exceeded $900/MBF. Chip-n-saw and pulp logs continue to have low demand and minimal markets across the region.

Exports to China are now averaging $580/MBF for Douglas fir and $530 for whitewoods. Exports to Japan remain competitive as export sawlog pricing is averaging around $850/MBF, which is greater than much of the domestic market.

![]()

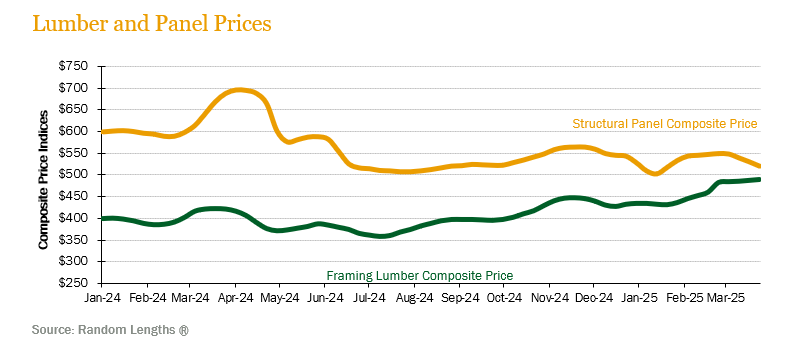

LUMBER AND PANELS — Lumber prices rose during the quarter. The Random Lengths® Framing Lumber Composite Price ended the quarter up 13.2% despite being down 4.2% from year-ago levels. Structural panel prices fell 4.2% during the quarter and prices are 24.4% below March 2024 levels.

PULP AND PAPER — Demand for paper products remained relatively flat though pulp demand strengthened during the same period. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 4.2% for the quarter and finished 15.6% above year-ago levels. US newsprint (27.7 lb.) prices stayed flat across the quarter and ended 0.6% above March 2024 levels. Boxboard prices remained consistent quarter over quarter but are down 1.4% from last year’s level.

![]()

TRANSACTIONS — As reported above, the biggest news of the first quarter was Rayonier’s sale of 287,000 acres of timberland in New Zealand to The Rohatyn Group (TRG) for a reported price of $710 million. TRG acquired Rayonier’s full share of its New Zealand joint venture (77%), implying a full asset valuation of approximately $922 million. The sale puts Rayonier above its stated disposition goal of $1 billion and reflects its refocusing on core U.S. markets. In Canada, Eastwood Forests purchased 35,830 acres in British Columbia from Wagner Forest Products for a reported price of $69.2 million.

In the U.S., key sales included the FIA sale of 11,000 acres in Texas to Resource Management Services and Weyerhaeuser’s sale of 6,300 acres to Chinook Forest Partners.

Following news shared last quarter, a consortium purchase of Rayonier land in the Olympic Peninsula again made headlines with EFM announcing a long-term contract for the delivery of 676,000 nature-based carbon removal credits through 2035 to tech giant Meta.

TRANSACTIONS IN PROGRESS — A flurry of offerings also hit the market during the first quarter of 2025, with many taking bids at the end of the quarter. Investors continue to monitor these pending transactions, while a handful of other offerings are taking bids in the second quarter. While average deal size is trending smaller in the U.S. thus far in 2025, transaction volume is off to a fast start.

![]()

Following a period of stabilization and moderate recovery in 2024—driven by U.S. economic growth and improving global trends in trade, commodity prices, and inflation—the first quarter of 2025 opened with renewed uncertainty. This stems largely from the announcement and rapid revisions of sweeping U.S. tariffs on imports from nearly all global trading partners.

While it is too early to assess the long-term implications for the global forest sector, the short- and medium-term effects have been disruptive. Volatility in trade policy is adding friction to global markets, with potential winners and losers among key forest product exporting countries depending on their exposure, trade dependencies, and competitive positioning. As policy direction becomes clearer, we will better understand the sector-specific risks and opportunities that may emerge.

CHILE — In Chile, inflation remained high in March 2025, with an annual CPI of 4.9%, primarily driven by fuel and energy prices. However, underlying inflation decreased to 3.7%, reflecting a moderation of inflationary pressures. The Central Bank maintains a cautious stance, with expectations that the monetary policy rate will stay above 4.5% over the next two years.

Global trade tensions, especially caused by the new tariff policies from the United States, have created uncertainty in the markets. Although Chile was only affected by the minimum 10% tariff, it is estimated that 2% of its exports could be impacted, reducing the projected growth for 2026. The Chilean forestry sector is taking preventive measures, such as market diversification. The creation of the National Forestry Service, which will replace the National Forestry Corporation, is an important step forward in strengthening the institution to serve the sustainable development of the forestry sector.

Between 2024 and 2025, domestic timber prices remained stable despite international uncertainty. While there have been slight price variations depending on region and species, there has been no widespread decline.

BRAZIL — Brazil’s GDP ended 2024 with a growth of 3.4% which is expected to carry forward through 2025 with an additional 2.0% growth. Inflation exceeded expectations in 2024, and the pattern is expected to continue to 5.65% despite the Brazilian Central Bank being committed to correcting inflation to 3.00%. The external environment remains challenging due to overall uncertainties brought by additional volatility from the United States tariffs changes. Domestically, economic activity and the labor market have shown greater dynamism than expected. Financial conditions and the exchange rate have continued to fluctuate, with the appreciation of the Brazilian real up 7.3% over the first quarter. The Central Bank raised the interest rates by 100 basis points to 14.25% during Q1 COPOM meetings.

In Brazil’s forest sector, pulp prices are expected to remain steady through the short term with Chinese investments having anticipated long-term impacts as they implement vertical integration. Expectations for Brazilian paper, packaging, and board production and prices remain strong. Despite healthy projections, there may be weak performance by specific companies due to maintenance issues and low pulp prices through the beginning of the year.

![]()

FIA was delighted to participate in IPE Real Assets’ Natural Capital magazine, published in January, highlighting the advantages of incorporating timberland into investment portfolios. The article includes analysis on volatility, resilience, and value preservation, along with the optionality provided by natural capital. The article is available on the IPE website.

As the field of natural capital investing matures, FIA is committed to advancing with credible, transparent reporting and growing the role of forest investment in addressing global environmental challenges. Our latest article, featured in the Agri Investor Sustainable Investment issue (published May 2025), shares two case studies in FIA’s efforts to promote integrity in natural capital. To learn more about how FIA’s forest carbon reporting with limited assurance and our EU Taxonomy alignment project seek to enhance trust in natural capital, on FIA’s website.

![]()

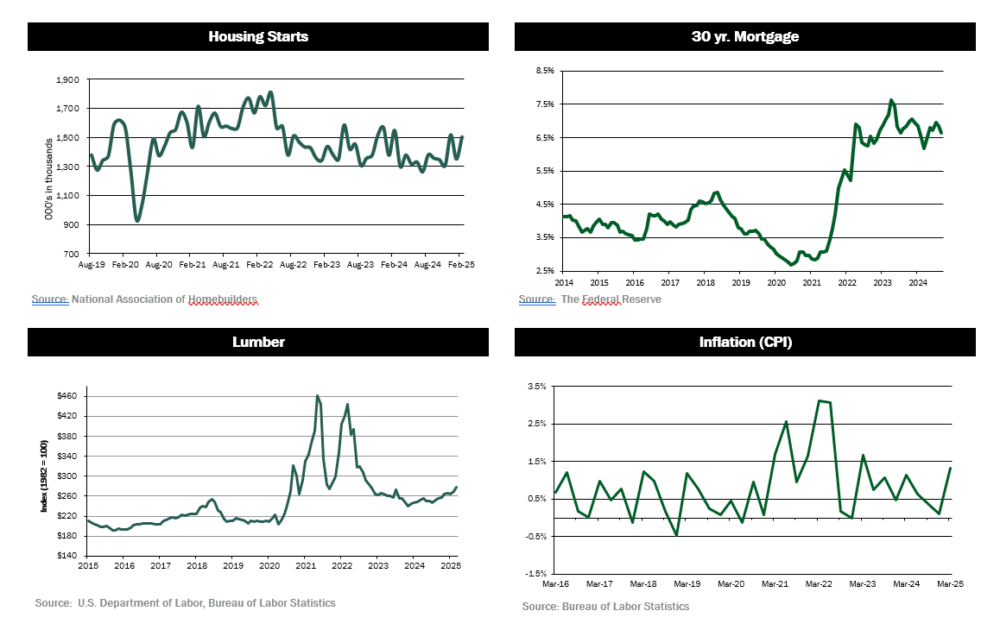

HOUSING — H0using starts reached a seasonally adjusted rate of 1.5 million in February, a 11.2% increase from January’s starts. Single-family starts had a noteworthy increase of 11.4% to 1.1 million units.

MORTGAGE RATES — 30-year fixed mortgage rates softened from a peak at 7.04% at the beginning of the year to end the first quarter at 6.65%.

JOBS — U.S. employers outperformed economists’ expectations by adding 228,000 jobs in March. For the fourth time in the last year, the unemployment rate reached 4.2%.

CONSUMER CONFIDENCE — The University of Michigan’s Consumer Sentiment Index dropped for a third consecutive month with many concerned due to uncertainty in economic and policy factors. Consumer confidence has fallen from 74.0 in December 2024 to 57.9 in March 2025 with expectations that it will continue to fall.

INFLATION — U.S. inflation cooled in March to a 6-month low, to an annual rate of 2.4% from 2.8% in February. Yet 12-month inflation expectations soared to 6.7% this month, the highest reading since 1981, from 5.0% in March, as reflected in the University of Michigan’s survey of consumers. Over the next five years, consumers saw inflation running at 4.4% compared with 4.1% in March.

TRADE DEFICIT — While the outlook for trade deficits has become complicated in the transition to the new administration, in February it stood at a monthly level of $122.7 billion.

INTEREST RATES — While the 10-year U.S. treasury yielded around 4.3% as of the end of the first quarter, yields climbed early in the quarter as a response to the proposed tariffs. The 30-year treasury also reflected an increase in yields jumping from 4.5% to closer to 5% in early April.

OIL PRICES — Oil prices stood at a level around $75 per barrel at the end of the first quarter but dropped to below $65 in response to the tariff proposals and related market turmoil.

U.S. DOLLAR — The US dollar index ranged between 104 and 110 throughout the first quarter but fell to the 100 level in early April in reaction to the tariff situation.

![]()

Disclaimer: Certain information contained in these materials has been obtained from third-party sources. While such information is believed to be reliable for the purposes used herein, FIA makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein. This does not constitute an offering of any investment or an inducement to participate in any investment or investment advice. Past performance does not guarantee future performance. FIA is a Registered Investment Adviser with the Securities and Exchange Commission in the United States.