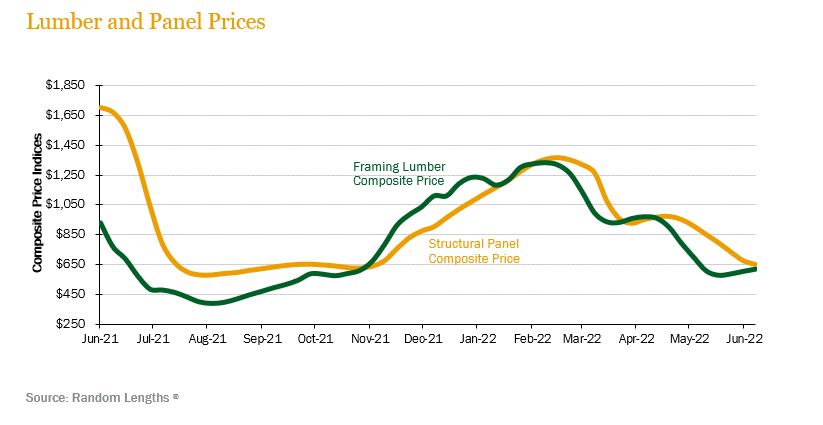

SUMMARY UPDATE — Log prices in the Pacific Northwest remained elevated over the quarter compared to prior years, while demand across the U.S. South retracted. Northeastern markets remain stable with demand increasing for select species across the region. Lumber and panel prices declined, falling from the most recent highs seen in March. The Random Lengths® Framing Lumber Composite Price ended the quarter down 37% and prices were 19% lower than what they were a year ago.

Inflation continues to impact forest operations, as cost of goods and services are now at forty-one year highs. Housing starts dropped 2.0% to a seasonally adjusted annual rate of 1.559 million units in June. Mortgage rates have been volatile, with the average rate on a 30-year fixed mortgage falling to 5.30% the second week of July.

TIMBERLAND MARKETS — The headline deal of the second quarter was PotlatchDeltic’s announcement that it had agreed to purchase fellow publicly-traded REIT, CatchMark Timber Trust. The all-stock transaction valued CatchMark at $12.88/share at the time of the announcement, representing a 55% premium to its share price. PotlatchDeltic will add approximately 350,000 acres in Alabama, Georgia, and South Carolina to its timberland holdings as a result of the transaction. Analysts estimate the value paid for the timberlands to top $900 million at the announced valuation. The deal is expected to close in the third quarter. The other major news of the quarter was Weyerhaeuser’s purchase of 80,800 acres in North Carolina and South Carolina from Campbell Global for $265 million. The lofty $3,280/acre price shows continued strength in US South timberland valuations, along with continued interest in higher and better use (HBU) land sale markets. There were several other announcements and closings in the second quarter, setting 2022 up to be one of the largest timberland transaction years in recent history.

![]()

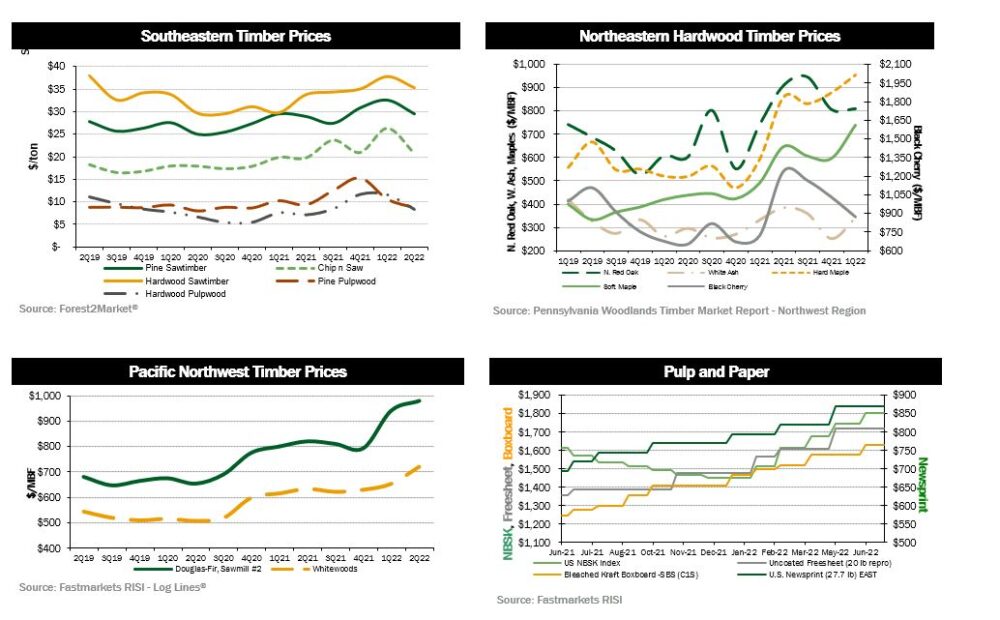

SOUTHEASTERN — Demand for pine timber retracted over the second quarter. Forest2Market® reports price declines for all five major pine and hardwood products. Pine sawtimber decreased 9.4% over the quarter, however prices remain 2% above year ago levels. Pine chip-n-saw prices fell 20.9% over the quarter, nearly losing all of the gains reported in first quarter. Pine pulpwood prices softened for the second consecutive quarter, dropping 17.8%. Hardwood pulpwood and sawtimber decreased 17.8% and 6.5% respectively over the second quarter.

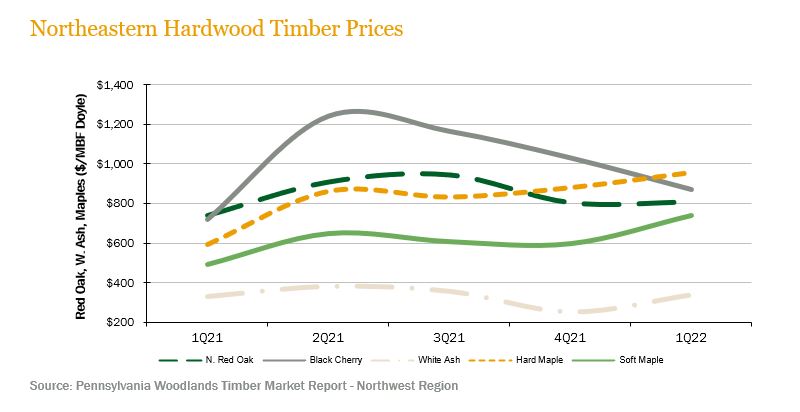

NORTHERN HARDWOODS — In the Pennsylvania wood markets, demand for key species increased over the quarter. Most notably, according to the Pennsylvania Woodlands Timber Market Report, white ash prices increased 35.1% during the first quarter (the most recent publicly reported pricing), ending the quarter 2.6% above year-ago levels. Soft Maple prices increased 23.9% while hard maple and Red Oak prices increased 8.7% and 0.4% respectively over the quarter. Black cherry prices declined 15.5%, continuing to fall from the peak pricing seen in second quarter 2021.

In Pennsylvania, demand for hardwood sawtimber has remained strong for all species except Black Cherry. Pricing remained relatively flat from the first quarter. However, some mills did pay premiums if they needed a certain species. Ash pricing has increased but that is because of the lower harvest levels of ash. Most stands that could be harvested with ash have been harvested over the past 6 years due to Emerald Ash Borer.

Wisconsin hardwood lumber and veneer log markets remained strong throughout the second quarter. Demand for hardwood pulpwood has been very strong and pricing has increased significantly. The demand for Hard Maple has also been very strong with pricing increasing slightly.

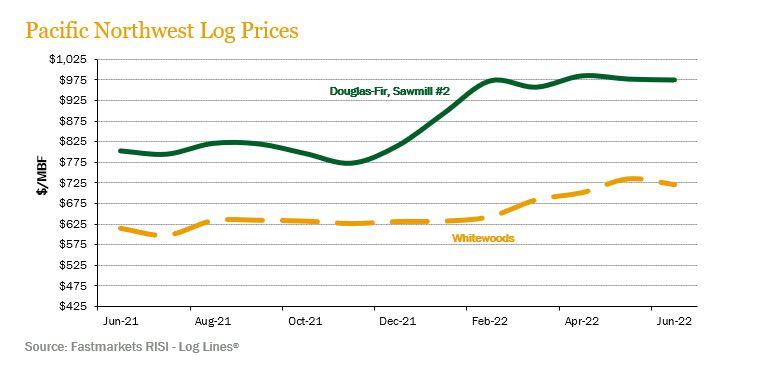

PACIFIC NORTHWEST — In the Pacific Northwest (PNW), strong pricing experienced early in 2022 continued through the second quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs increased 1.8% over the quarter, ending the quarter 21.6% above year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices decreased by 5.5% compared to the previous quarter and ended the quarter 17.4% ahead of last year’s level.

Wet weather in the late spring (April & May), caused log supply to slow and domestic sawmill inventory to drop during the second quarter. Log prices have generally flattened, but still remain strong and comparable to those seen earlier in the year. PNW domestic sawlog prices have held flat and are still currently around $900/MBF, with prices still reaching over $1,000/MBF in select Oregon log markets. Export demand from China has dropped, primarily due to ocean freight costs. Export prices are averaging $750/MBF. Premium prices are still being achieved for exports to Japan; prices are averaging around $1,250/MBF.

![]()

LUMBER AND PANELS — Lumber and panel prices decreased over the quarter, pulling back from higher prices seen in February. The Random Lengths® Framing Lumber Composite Price ended the quarter down 37.7%, over 19% lower than prices twelve months ago. Structural panel prices also decreased, falling 48.2% over the second quarter.

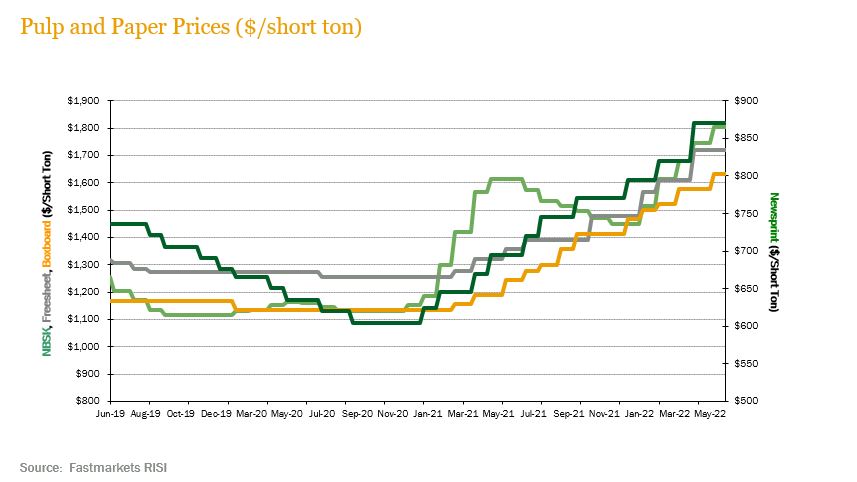

PULP AND PAPER — Pulp, paper and boxboard prices increased over the second quarter. The benchmark NBSK (northern bleached softwood kraft) pulp price index increased 11.8%, ending the quarter 11.8% above year-ago levels. U.S. Newsprint (27.7 lb.) prices increased 6.1% over the quarter, ending 25.2% above last year’s level. Freesheet prices increased 6.9% over the quarter, ending 26.8% above last year’s level and boxboard prices increased 7.2% over the quarter, ending 30.9% above last year’s level.

![]()

TRANSACTIONS — In the South, the biggest news of the second quarter was the announcement that PotlatchDeltic (PCH) had reached an agreement to purchase CatchMark Timber Trust (CTT) and its 350,000 acres of timberland in Alabama, Georgia, and South Carolina in an all-stock transaction. The deal valued CTT at $12.88/share at the time of announcement, representing a 55% premium to its trading price. Analysts estimate the value paid for the timberlands to top $900 million at the announced valuation. The other major news of the quarter was Weyerhaeuser’s purchase of 80,800 acres in North Carolina and South Carolina from Campbell Global for $265 million. The lofty $3,280/acre price shows continued strength in US South timberland valuations, along with continued interest in higher and better use (HBU) land sale markets. Timberland Investment Resources purchased 31,420 acres in northern Alabama and Georgia from Manulife for a reported price of $64.8 million. The deal had originally been on the market in 2020. Elsewhere in the South, Superior Pine Products announced its purchase of 58,000 acres in Arkansas and Louisiana from Molpus Woodlands Group for an undisclosed price. Several other transactions in the South are set to close in the third quarter.

In the Northwest, New Forests announced its purchase of 108,000 acres in northern California from The Michigan-California Timber Company for an undisclosed price. Investors continue to wait for the results of Campbell Global’s 18,000-acre offering in western Washington, which should close early in the third quarter.

TRANSACTIONS IN PROGRESS — Investors continue to wait for word on several large-scale timberland offerings, particularly in the South, that received bids in the second quarter. Investors will be closely monitoring the outcome of these offerings in the coming months as total value of pending transactions could surpass $800 million.

![]()

During the second quarter of 2022 the global economy continued transitioning to a state where we have generally learned to live with the dynamics imposed by the COVID19 pandemic, yet two new challenges arose that dampened global economic recovery: the Russian attack on Ukraine, and global inflation that has reached levels not seen in a generation. A global supply chain that was already under pressure from pandemic related shortages was further exacerbated by the impact on energy prices of sanctions on Russian oil exports as well as the decrease in commodity exports from Ukraine. In the US, inflation soared past 8.0% during the quarter, the highest rate in the last quarter of a century. This drove the US Fed to aggressively tighten monetary policy by 75 basis points during their June meeting to reach a level of 1.50 to 1.75% and is expected to continue the restrictive cycle until the end of the year. Other major economies, such as the Eurozone and the UK, also reached record high inflation of 8.1% and 9.1% respectively. As governments struggle to contain inflation, probability of an important group of the major global economies falling to a recession early in 2023 or sooner has increased.

In Australia, the Forest and Wood Products Australia corporation (FWPA; a forest industry R&D group) recently published a report on the future market dynamics of Australia’s timber industry. Some key summary findings project that given Australia’s population growth which is expected to expand by 30% or more by 2050, demand for sawn wood derived from softwood timber would increase by almost 44% to reach approximately 6.5 million m3 per year. With the lack of timberland area expansion over the last decades, domestic sawmilling capacity is projected to remain relatively static at 3.6 to 3.8 million m3 per year. Imports would need to be substantially ramped up, and almost tripled, to make up the gap. The main driver for increased demand, beyond the demographic growth, is the high use of timber products in construction as well as important other uses for timber products such as packaging and industrial use.

The New Zealand log export market ended the quarter with cyclical weakness mainly driven by slowdown in the Chinese economy due to typical lower activity in Chinese construction during the hot summer months and further complicated by COVID19 lockdowns dampening the Chinese economy. NZ logs landed in China were between $140 and $150 USD. Prices are expected to slowly and conservatively rebound over the coming months.

CHILE — Inflation in Chile, as in the rest of the world, soared to historic heights during the period. In June, Chile’s Consumer Price Index (CPI) posted a year to date increase of 7.1%, with year over year inflation reaching 12.5%. In an effort to bring inflation back to their target 3.0% in the near future, the Central Bank of Chile tightened monetary policy by increasing the interest rate to 9.0%. Politically, in the coming months Chileans will go to the polls to vote on the proposed new constitution. The referendum will happen on September 4th and is expected to review the economic and social model that has been in place for the past forty years, as well as address updates needed for the current political structure, the provision of social goods and the protection of the environment.

In Chile’s forest industry, exports have continued to grow throughout 2022, and while the sector expects good performance to continue, there are also rising concerns related to increasing freight rates as well as global logistical challenges. During March (latest data available) $755 million USD worth of Chilean forest products were exported which accrued to an accumulated $1,712 million USD during the initial quarter of the year. This figure exceeds by 7.2% the historical heights of 2018. The main products that increased their exported amounts were radiata pine bleached pulp, wood moldings and sawn wood. China and the United States continue to be the main destination for Chilean forest product exports.

BRAZIL — In Brazil, the COPOM (Monetary Policy Committee) moved swiftly to tighten monetary policy amid the heightened inflation environment. By the end of the quarter, Brazil’s interest rate reached 13.25% and is generally expected to remain at this level throughout the rest of the year. Although further rate hikes are not off the table yet depending how the second half of the year evolves. High energy, fertilizer and other commodity prices have driven inflation to 11.89% year over year. Another impact in Brazil during the quarter was felt in the public markets where, after achieving a zenith in April (+17% YTD) the Brazilian stock market moved in tandem with most global markets to retreat during the quarter, eroding year to date gains to end the quarter flat for the year.

In the forest sector, pulp pricing trends continued stable through June supported by tight supply-demand dynamics. Further price hikes in Asia and Europe of 20 to 30 USD per ton for Bleached Eucalyptus Kraft Pulp (BEKP) have been announced, regardless of headwinds in the global economy. But looking forward these could be the last hikes as challenging conditions for pulp buyers heading into the second half of the year are hurting their profit margins.

In other Brazil news, during the quarter Forestal Arauco, a major Chilean pulp producer, announced the construction of a new pulp mill in the state of Mato Grosso do Sul. The 2.5-million-ton hardwood pulp mill is planned to begin operations in 2028. CAPEX for the project is estimated to be three billion USD with construction expected to initiate in 2025. An estimated two hundred thousand hectares of plantations will be required to furnish the mill with the required pulpwood volumes.

Finally, during this quarter FIA celebrated it’s tenth year anniversary of having made our first investment in the country on behalf of FIA’s investors. This marks an important milestone for the firm and our clients and confirms FIA’s long-term commitment to continuing to be an important player in the Brazilian forest industry.

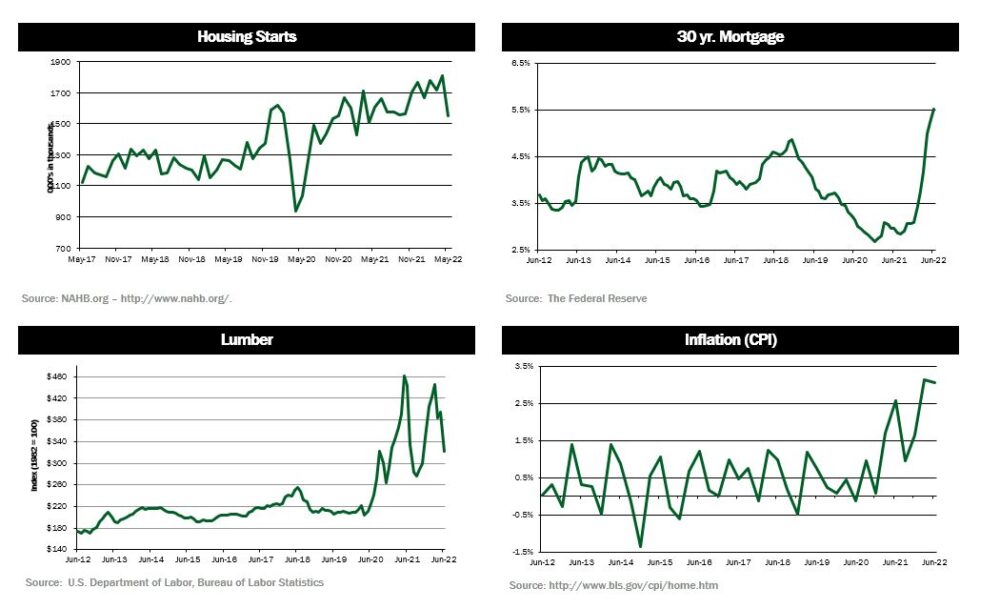

![]()

HOUSING — Housing starts dropped 2.0% to a seasonally adjusted annual rate of 1.559 million units in June. Starts are down 13.6% from peak values posted in April.

MORTGAGE RATES — Mortgage rates have been volatile, with the average rate on a 30-year fixed mortgage falling to 5.30% the second week of July, down from 5.70% a week prior. A year ago, the 30-year rate was averaging 2.90%.

JOBS — Employers added 372,000 jobs in June, a surprisingly robust gain and in line with the pace of the previous two months. Economists had expected job growth to slow sharply given the broader signs of economic weakness.

CONSUMER CONFIDENCE — In June the consumer confidence index fell to a 16-month low of 98.7 and the consumer expectation index hit its lowest since 2013 at 66.4.

INFLATION — In June, the Consumer Price Index for All Urban Consumers rose 1.3%, seasonally adjusted, and rose 9.1% over the last 12 months. Inflation is now at the highest level in 41 years.

TRADE DEFICIT — The trade deficit in May amounted to $85.5 billion, down slightly from April.

INTEREST RATES — In June, the Fed raised rates by 75 basis points, the highest increase since 1994. The increase was the third interest rate hike of 2022 and pushed the federal funds target range from 1.5% to 1.75%. Expectations are for an additional 75 basis point increase.

OIL PRICES — After spiking to as high as $120 / barrel in early June, oil has recently dropped below $100. Markets remain volatile given supply disruptions and an unclear outlook for demand given recession risks.

U.S. DOLLAR — The US dollar recently hit parity with the Euro, the first time in 20 years, reflecting relative demand for the currency given an increase in US interest rates.

![]()