Summary Update

Timber and Product Prices — Over the final quarter of 2019, Pacific Northwest product prices showed moderate increases, however, “phase one” trade implications still linger. Northern hardwood markets continue lagging expectations as export and domestic demand remains depressed. Southern pine markets saw minor increases over the fourth quarter, however, markets ended down year-over-year. Lumber and panel prices ended the year well above the three-year lows reported in June.

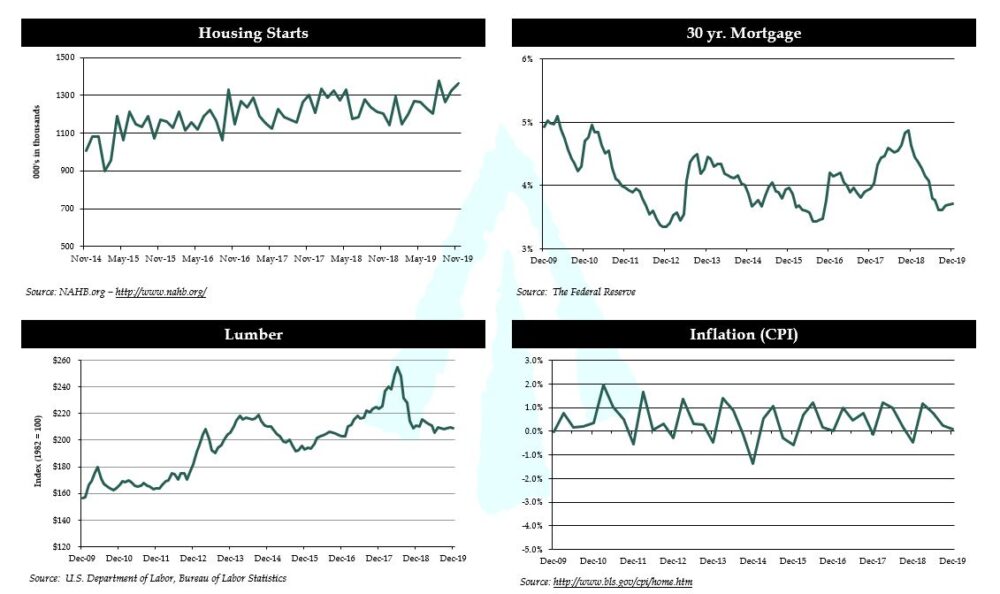

December housing starts were at a seasonally adjusted annual rate of 1.608 million units. The December 2019 rate was 16.9% above the revised November rate of 1.375 million units, and 40.8% above the December 2018 rate of 1.142 million units. The average interest rate for 30-year fixed rate mortgages increased slightly in December 2019, reaching 3.72%; two basis points higher than the 3.70% reported in November.

Timberland Markets — The biggest news of the fourth quarter was word that Hancock agreed to sell 86,600 acres in east Texas to Molpus for an undisclosed price. Analysts expect the property to trade for $140-150 million, making it only the third transaction of 2019 to top the $100 million mark. Lyme Timber also made news last quarter with a publicly announced agreement to purchase 92,200 acres in the Upper Peninsula of Michigan from Hancock for a reported $94.5 million. Finally, Molpus and Jamestown are the reported buyers of 35,250 acres – split into two separate packages – in Alabama from Hancock for north of $60 million.

With 2019 transaction value checking in at under $2 billion, it has been a down year. Typical transaction values the past several years have hovered between $2.5 to $3 billion. One driver has been a lack of large offerings, with only three sales topping the $100 million mark on the year. Publicly traded timber REITs have also been mostly quiet in the 2019 transaction landscape.

Timber Prices

Southeastern — Average prices across the Southeast over the final quarter of 2019 experienced mixed results amongst major products. Forest2Market® reported a 2.6% increase in Southern pine sawtimber prices over the fourth quarter of 2019; prices ended the quarter 4.5% below last year’s level. Pine chip-n-saw prices grew 1.8%, ending the year 12.9% below year-ago prices. Pine pulpwood prices retracted 1.2% over the quarter, keeping prices well below last year’s level. Hardwood pulpwood prices decreased for the third consecutive quarter, falling 12.7%. Hardwood sawtimber prices experienced modest gains, rising 4.9% over the final quarter of 2019.

Southeastern Timber Prices

Northern Hardwoods — Hardwood markets remain weak; however, pricing levels appear to be stabilizing as mills adjust production to coincide with current domestic and export demand. According to the Pennsylvania Woodlands Timber Market Report, black cherry prices dropped 17.8% during the third quarter (the most recent publicly reported pricing), ending 39.4% below year-ago levels. Northern red oak prices dropped 8.6% over the quarter, falling for the fifth consecutive quarter. Hard maple prices gave up last quarter’s gains, falling 18.0% and ending down 22.0% year-over-year. Soft maple prices saw positive gains, rising 9.7% and ending the quarter 15.4% below last year’s level.

Hardwood lumber markets in Wisconsin are stable. Steady demand and pricing continued through the quarter for hard maple, basswood and birch sawlogs. Logging conditions were decent throughout the fourth quarter. Sawmill log inventories remained manageable, which should provide good market opportunities in the first quarter. Hardwood pulpwood markets remained constant over the quarter and yard inventories are healthy as the “winter build” period begins.

Northeastern Hardwood Timber Prices

Pacific Northwest — Pacific Northwest markets showed moderate signs of strengthening over the final quarter of 2019. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs increased 5.2% over the fourth quarter, ending the quarter 4.5% below year-ago levels. Whitewoods (i.e., true firs and hemlock) average delivered log prices dropped 1.6% and ended the year 13.9% below last year’s level.

Chinese demand remains flat while buyers anxiously await “phase one” trade deal implications. Demand from Japanese buyers has seen some minor increases throughout the fourth quarter. Domestic specialty mills and high production sawmills continue to be strong buyers; however, demand is very site specific.

Pacific Northwest Log Prices

Product Prices

Lumber and Panels — Lumber prices posted positive gains for the quarter, ending 2019 well above the lows experienced in June of this year. Panel prices, however, continue to lag and remain below the historical five-year average. The Random Lengths® Framing Lumber Composite Price showed small gains over the fourth quarter, rising 1.6%; ending the year 12.3% above last year’s level. The Structural Panel Composite Price basically held flat, dropping only 0.3% over the quarter, however the index ended 2019 6.9% below year ago prices.

Lumber and Panel Prices

Pulp and Paper — Pulp, paper and boxboard prices were relatively stagnate over the final quarter of 2019, however the major indices saw marked declines over the full calendar year. The benchmark NBSK (northern bleached softwood kraft) pulp price index dropped 1.6% over the quarter, ending 20.5% below year-ago levels. U.S. Newsprint (27.7 lb.) prices decreased 4.2% over the quarter, ending the year 9.8% below last year’s level. Boxboard and uncoated freesheet prices remained unchanged over the quarter.

Pulp and Paper Prices ($/short ton)

Timberland Markets

Transactions — In the South, Molpus is reportedly purchasing 86,600 acres in Texas from Hancock for an undisclosed price. Hancock also sold a two-part package totaling 35,200 acres in Alabama to Molpus and Jamestown for what is expected to be north of $60 million. In Florida, the privately held Knight Timberlands, a 55,000-acre package, sold to a group of private investors for a total of $67.5 million. Finally, Lyme Timber purchased 47,000 acres of hardwoods in northern Alabama and Tennessee from Coastal for a reported price of $36.3 million.

In the Lake States, Lyme Timber reportedly closed on its purchase of 30,600 acres in Wisconsin from FIA for an undisclosed price. In the Upper Peninsula of Michigan, Molpus reportedly closed on a 14,300-acre privately held package, but a price was not yet known at publishing time.

Transactions in Progress — With a flurry of deals closing in the fourth quarter, not many offerings remain in progress in 2020. However, one large deal was announced at the end of December. Weyerhaeuser has reached an agreement to sell its Montana holdings, 630,000 acres in total, to Southern Pine Plantations for $145 million. The transaction is expected to be finalized sometime in the second quarter of 2020.

With 2019 transaction value checking in at under $2 billion, it has been a down year. Typical transaction values the past several years have hovered between $2.5 to $3 billion. One driver has been a lack of large offerings, with only three sales topping the $100 million mark on the year. Publicly traded timber REITs have also been mostly quiet in the 2019 transaction landscape.

International Update

As 2019 concludes, it isn’t hard to believe that global forest products markets are in the midst of a major change. The headline grabbing, and market disrupting, trade war between the U.S. and China is rumored to reach an early-2020 cease fire in the form of a “phase one” agreement between the two counties. Little is known about the fundamentals of this preliminary agreement; however, markets are generally skeptical a clear, holistic solution will be communicated. As markets navigated demand-based shifts due to volatility from the trade war, supply disruptions due to natural disasters also took center stage during 2019. Fallout from the 2017 Chilean fires and the 2018 U.S. hurricane season, coupled with the emerging catastrophes from the current Australian fire season and central Europe’s spruce bark beetle outbreak, are set to affect historical trade flows. Despite the disruptive events in major timber producing regions, forests continue to be recognized for their positive carbon footprint and sustainable nature. As we move into the 2020s, forest investments are set to provide answers to many questions in the global environmental and sustainability arenas.

Similar to the U.S., global timberland transactions were slower than average but were characterized by several larger sized deals. BillerudKorsnäs sold its stake in Bervik Öst which controlled 350,000 hectares of Swedish forestland to Stora Enso for an imputed SEK 6.4 billion ($640 million USD). In Uruguay, Harvard Management Company sold 55,000 hectares for $330 million USD to a group of local pensions. A late year announcement of GFP’s acquisition of RMS’ Tasmanian hardwood estate was also one of the headlines. This 36,000 hectare (21,200 plantable hectares) property was formally owned and managed by the MIS, Forest Enterprises Australia. In Brazil, Suzano and Klabin announced unrelated strategies to consolidate additional land ownership in the states of Mato Grosso do Sul and Paraná/Santa Catarina/São Paulo respectively.

Chile — During the quarter, Chile experienced unexpected social unrest. What began as a small government-imposed increase in subway fares, evolved to protests expressing deep-seeded dissatisfaction with the status quo. Chileans, both its citizens and governmental officials, along with external observers were all surprised by this dynamic. Discontent centered around issues such as minimum wage, public health and inequality. On October 25th the crisis peaked with a march that included more than one million Chileans demonstrating in the capital. The main demand was for a drafting of a new constitution. After a few weeks of uncertainty and the replacement of key cabinet members, Chile’s government proposed a mechanism that deescalated the situation and will allow Chileans to decide if a new constitution will be drafted. This will be done using the current constitutional processes via a referendum that will take place in April 2020. If the vote is for a new constitution, it could take up to two years for Chile to draft its new constitution following the mechanisms and processes established in Chile’s existing institutions.

The effect of the social unrest was immediately felt by Chile’s economy. October’s reading of the IMACEC, Chile’s monthly economic activity index, showed a contraction of 3.4%. As a response, the government announced a $5.5 billion USD plan to boost the economy underpinned by three pillars: protection of employment and family income; increased public investment; and support for small and medium sized companies. The Central Bank also intervened in the currency spot markets to provide market liquidity and stabilize the exchange rate which, at its weakest, reached 828 Chilean pesos per dollar (a 14% loss of value vs. the start of Q4). After the intervention, the peso strengthened back to 771 pesos per dollar by end of quarter (a 6% loss of value vs. the start of Q4). Copper prices, which is Chile’s main export, increased by almost 12% during the quarter due to the view that global copper demand will increase. This is expected to provide support for Chile’s economy and help navigate the challenges that lay ahead.

Within the context of the slowdown, Chile’s forest sector is projected to export $5.6 billion USD for 2019. This would be an 18% year-over-year decrease from 2018 which was a historic year for Chilean forest exports. However, 2019 exports are aligned with average exports over the last decade. The main underperformance was driven by global market softness in pulp (both pine and eucalyptus) as well as plywood.

Arauco, one of Chile’s major pulp producers, confirmed that its project to expand their Arauco pulp manufacturing facility (MAPA) continues to make strong progress. MAPA, which contemplates an investment exceeding $2.0 billion USD to create a brand-new bleached eucalyptus kraft line with annual capacity of 1.56 million tons, is about a third of the way completed with major foundations done and civil works underway. All the latest pulp manufacturing equipment which had already been purchased before the currency spiked has been shipped from Finland and should be arriving in Chilean ports over the next few months.

Brazil — Further Q4 loosening of monetary policy occurred as the Brazilian Central Bank lowered the overnight rate (SELIC) to 4.5%. This has been an historical reduction in Brazilian interest rates. During 2019, the SELIC has been reduced from 7.0% to the current rate of 4.5%, a modern day low. Late Q3 increases in industrial production slowed during Q4 leading most projections for 2019 GDP growth to hover around 1.2%. Average forecasts have 2020 GDP growth estimated at 2.2% with continued low inflation.

Global hardwood pulp prices have seemed to find ground although the roughly $100/ton spread between softwood and hardwood pulp has continued to drive softwood for hardwood substitution in China. The lunar new year begins mid-January and the market will be carefully looking at buyer behavior coming out of the holiday. Suzano made its first big post-merger announcement with a Q4 disclosure that it has consolidated 100,000 hectares of planted area and a pulp mill license in Mato Grosso do Sul. The new mill will have an installed capacity of 2.2 mill tons of pulp. In other business developments, the Duratex/Lenzing partnership agreement closed and work has begun on the world’s largest dissolving pulp mill (450,000 tons) which will be located in the state of Minas Gerais.

Through Q3 (most recent data), Brazil’s forest products sector has been mixed. Exports have been down slightly in pulp (-0.4%); however, as the destocking of current inventories occurred, overall production reduced by a more meaningful -5.1%. Wood panel exports were -9.3% year over year despite an increase in domestic consumption (0.5%).

Economic News

Housing — U.S. homebuilding increased more than expected in the fall with permits surging to a 12-1/2-year high while housing starts rose to 1.37 million.

Mortgage Rates — Mortgage rates ended the year low, only to fall further in early January, to an average of close to 3.6% for a 30 year fixed rate loan.

Jobs — Unemployment remains at a 50-year low of 3.5%, with 2019 clocking in as the ninth straight year in which new hires topped the 2 million mark.

Consumer Confidence — U.S. consumer confidence remains strong, dipping slightly in December to 126.5 from 126.8 in November.

Inflation — While low by historical standards, consumer inflation hit 2.3% for 2019, the highest mark since a 3% increase in 2011.

Trade Deficit — The US trade deficit narrowed to $43.1 billion in November 2019 from a downwardly revised $46.9 billion gap in the previous month. The trade gap shrank for the third straight month to the lowest since October 2016.

Interest Rates — The Fed trimmed its benchmark federal funds rates to a range of 1.5% to 1.75% in three quarter-point moves last summer and fall, while the 10-year treasury yield has declined from approximately 2.7% as of the beginning of the year to 1.9% as of the end of the year.

Oil Prices — The spot price of Brent crude oil averaged $67 a barrel in December 2019, up $4 per barrel from the average in November and $10 per barrel higher than in December 2018.

U.S. Dollar — The U.S. dollar, as measured by the U.S. dollar index, remained in a relatively tight and static range over the fourth quarter, close to 98.

The FIA Timber Economics “Quarterly Dashboard”