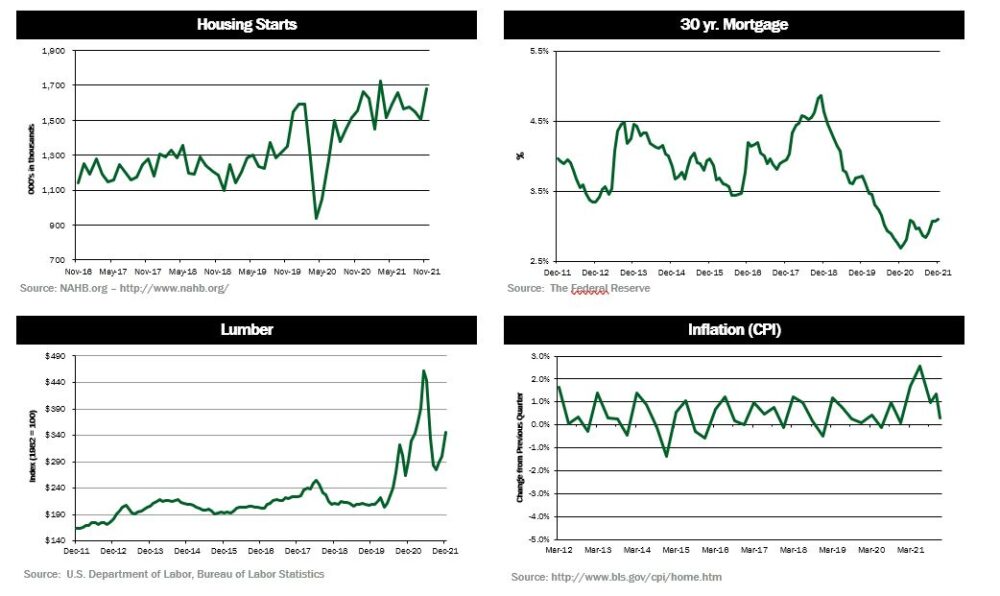

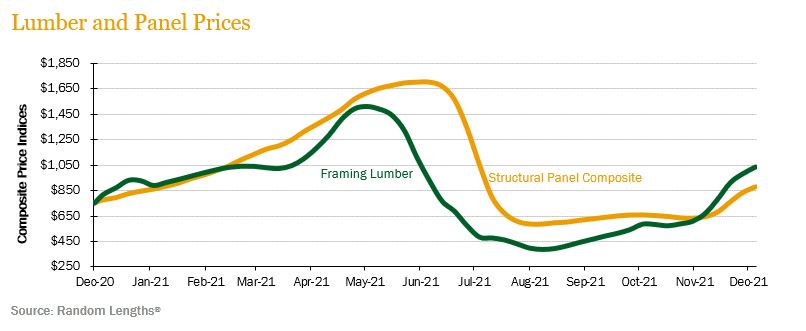

SUMMARY UPDATE — November housing starts rose to a multi-month high of 1.679 million, which was 11.8% above the October rate of 1.502 million, and 8.3% above the November 2020 rate of 1.551 million. Interest rates for 30-year fixed mortgages increased during the quarter, resulting in an average rate of 3.08%. Lumber and panel prices also increased over the quarter. The Random Lengths® Framing Lumber Composite Price increased 133%, ending the quarter 35.6% above last year’s level. The Structural Panel Composite Price increased 57.5% over the quarter but ended 17.6% lower than the record-setting prices one year ago.

TIMBERLAND MARKETS — The fourth quarter saw a flurry of timberland transaction activity, as 2021 ended with approximately $3.5 billion in total domestic transaction value. This was the highest level of domestic timberland transactions since 2013, signaling a rebound from the COVID year of 2020 and overall strength in the industry. All major timberland regions had transaction activity in the year’s final quarter, with more closings expected to carry over into early 2022.

![]()

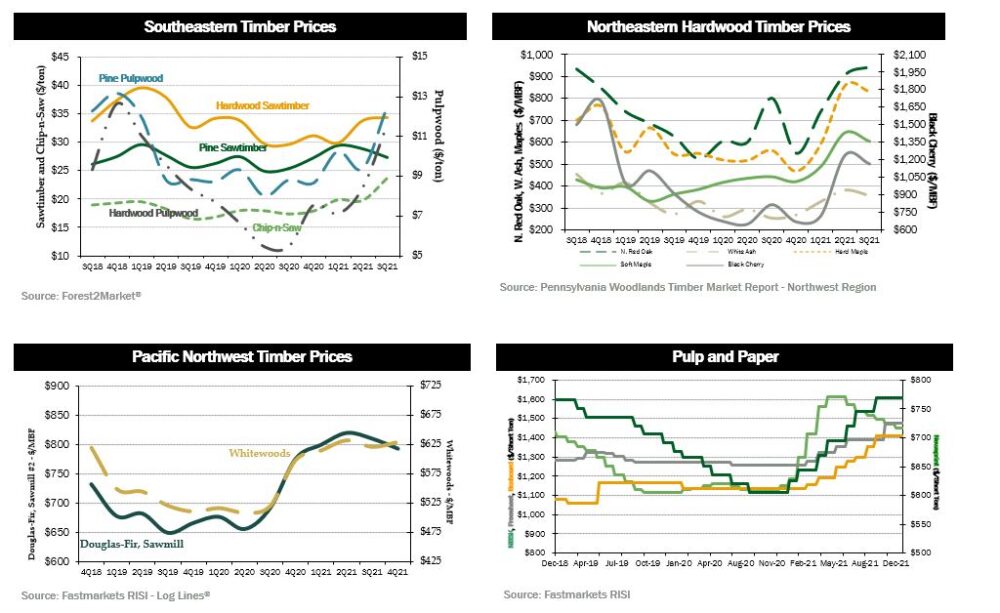

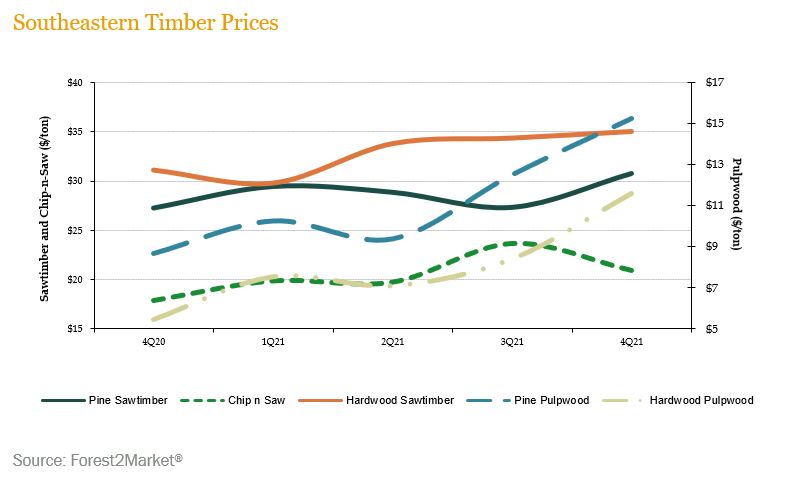

SOUTHEASTERN — Most of the major forest products in the U.S. South experienced increases in stumpage prices over the quarter. Forest2Market® reported a 12.5% increase in Southern pine sawtimber prices, ending 12.8% above last year’s level. Pine chip-n-saw prices dropped 11.5%, ending the year 17% above year-ago prices. Pine pulpwood prices increased 21.9% while prices ended very high at 75.7% year-over-year. Both major hardwood products also experienced increases. Hardwood pulpwood prices increased 37.8%, while hardwood sawtimber prices increased 12.55%.

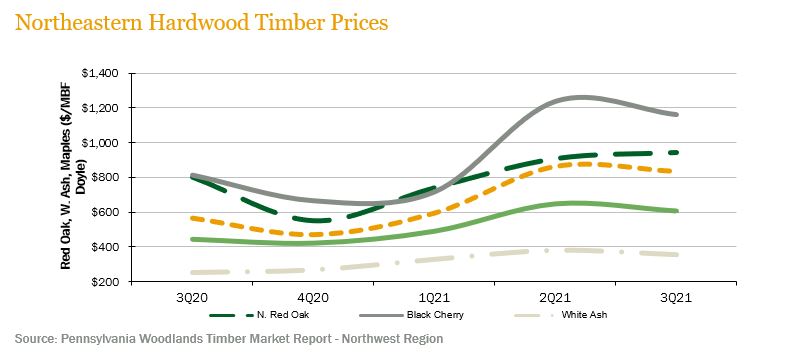

NORTHERN HARDWOODS — Northern hardwood prices, overall, saw a decrease over the third quarter of 2021 (the most recent reporting period). According to the Pennsylvania Woodlands Timber Market Report, black cherry prices fell 6.2%, ending the quarter 42.6% above year-ago levels. Northern red oak prices increased 3.9% over the quarter. Hard maple prices dropped 3.3%, ending the quarter at 47.4% year-over-year. Soft maple decreased over the quarter at 6.3%, ending 36.3% above year-ago levels.

In Pennsylvania and New York, hardwood lumber and log demand continued to be strong throughout the fourth quarter thanks to the strong pace in new home construction and remodeling in the U.S. and Canada. Export demand remained stable as there was not much improvement in the shipping/transportation bottlenecks and labor shortage issues. Container availability and cost continue to be a big drag on commerce. Exports to China and Vietnam did start to increase slightly toward the end of the quarter as Covid cases began to subside in those countries but there is still a lot of uncertainty surrounding China and whether their appetite for U.S. lumber and logs will expand in 2022. White oak, red maple, and hard maple were the strongest performers. Red oak, white ash, and tulip poplar were in very solid demand. BC continued to be the out of favor species. Wet weather in the quarter did help to reduce sawmill log inventories and should help stumpage demand in the New Year. Hardwood pulpwood demand remained stable.

In Wisconsin, strong demand continued throughout the quarter for hardwood lumber and veneer logs. Hard maple, yellow birch, ash, and basswood lumber were in high demand driven by strong U.S. and Canadian housing markets. Hard maple veneer log sales were brisk with stellar pricing. Flooring demand continued to help bolster the boltwood market. Hardwood pulpwood markets showed little improvement from last quarter as prices remained suppressed and yard inventories high.

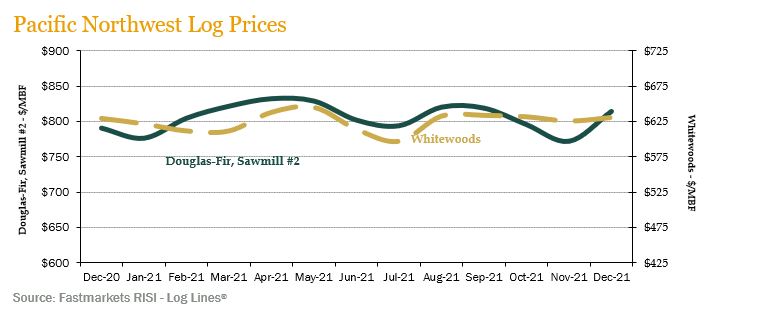

PACIFIC NORTHWEST — Pacific Northwest (PNW) markets experienced declines in demand during the quarter. Log Lines® reported that Pacific Northwest average delivered prices for Douglas-fir #2 logs decreased 0.6% over the quarter, ending 3.0% below year-ago levels. Average delivered log prices for whitewoods (i.e., true firs and hemlock) dropped 0.5% and ended the year 0.2% behind last year’s level.

![]()

LUMBER AND PANELS — Lumber and panel prices rebounded over the quarter. The Random Lengths® Framing Lumber Composite Price increased 133.3%, ending the quarter 57.5% above last year’s level. The Structural Panel Composite Price increased 35.6% over the quarter, ending 17.6% higher than year ago prices and well off the summer peaks.

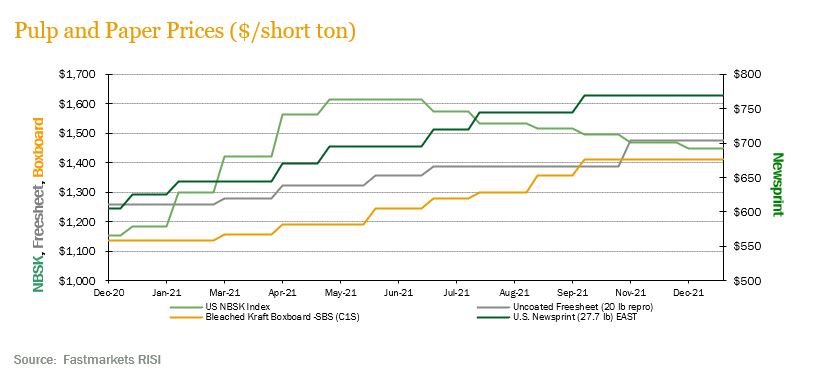

PULP AND PAPER — The benchmark NBSK (northern bleached softwood kraft) pulp price index decreased 6.2% over the quarter, ending 34.1% above year-ago levels. U.S. Newsprint (27.7 lb.) prices increased 7.2%, ending 23.1% above last year’s level. Freesheet and boxboard prices increased 2.4% and ended 10.5% above year-over-year levels.

![]()

TRANSACTIONS — In the South, the biggest news of the fourth quarter was the reported purchase of 41,000 acres of privately held timberland in South Georgia by Langdale Forest Products for an undisclosed price. Despite the young age-class profile of the forest, analysts estimated a purchase price north of $1,600/acre. Roseburg Forest Products also announced its purchase of 30,000 acres in Virginia and North Carolina from Forest Investment Associates for an undisclosed price. In Alabama, Timberland Investment Resources acquired 17,000 acres from a private seller for a reported price of $32.2 million. Conservation Forestry also completed the sale of 8,000 acres in Georgia to The Conservation Fund for a reported price of $14 million.

There was a flurry of transaction activity in the Pacific Northwest during the quarter. Rayonier successfully sold three properties in the fourth quarter. Rayonier sold a 12,700-acre property in Washington to Port Blakely for over $87 million. In Oregon, Rayonier sold 5,300 acres to Giustina for $37.2 million and another 12,800 acres to Fruit Growers Supply for $32.5 million.

In the Lake States, Keweenaw Land association reportedly found a buyer for its 180,000-acre offering located primarily on the Upper Peninsula of Michigan, although buyer and price are not yet known.

TRANSACTIONS IN PROGRESS — Investors continue to wait for word on several timberland offerings currently on the market in the South, Pacific Northwest, and the Lake States. Many of these offerings received bids late in the fourth quarter. Investors will be closely monitoring the outcome of these transactions in the coming months. After a slow start to the year, deal activity for 2021 easily surpassed that of 2020. With total transaction value of over $3.5 billion, this was the largest domestic timberland transaction year since 2013. With several large offerings set to receive bids in the first quarter, 2022 deal flow looks to be robust as well.

![]()

The second full year of the global pandemic began with positive momentum and optimism with the global early deployment of COVID 19 vaccines. The encouraging trend continued throughout the year as the historical global deployment of vaccines ramped up to end the year with almost half of the global population (49.5%) having received full vaccination and some countries even initiating deployment of booster shots. This allowed global markets to generally reopen in 2021 versus the great disruption of shutdowns in 2020. Yet the year was not without its challenges: in part due to the surge of new variants of the virus. First came the Delta variant which, although was initially detected in India in late 2020, was declared the dominant variant in the world by the World Health Organization during June 2021. And more recently, in November 2021, the Omicron variant was first detected in South Africa and, given how much more contagious it is versus previous variants, has quickly spread across the globe. A small encouraging sign though is that Omicron, although more contagious, appears to cause much less severe infections, especially to vaccinated individuals. The lack of severity has allowed markets and society to generally remain open; however, there are areas where labor and other shortages are manifesting due to the high caseloads and the associated quarantine protocols.

Another main challenge that added volatility and uncertainty to the global outlook was inflation, partially driven by the double impact of supply chain shocks due to the pandemic and excess liquidity from stimulus and savings due to the pandemic. In the U.S. the annual inflation rate for 2021 was 7.0%, the highest rate since June 1982, and is expected to remain high at least through the first half of 2022. Jerome Powel, the chairman of the U.S. Fed has pledged to take necessary actions to contain this inflation surge, including possible interest rate hikes. In China, the economy continued recovering but at a more moderate pace of 4.9% in the third quarter (latest data available) versus 7.9% in the second quarter, with the annual forecast still expected to be 8.2% for the full year.

The global forest sector continued to be dynamic and tight driven by supply chain shortages of logs and lumber as well as increased investor interest in the asset class for its carbon capturing characteristics. In Australia, the latest Timber Market Survey reported strong lumber and panel markets with both volume demand and prices surging. The most recent Australian Bureau of Statistics (ABS) data registered the highest level on record for new house construction starts (138,483) for the 2020-2021 financial year.

In an interesting development for log supply to China, European softwood logs exceeded supply from more traditional sources such as Russia and the U.S. During the first nine months of 2021, almost 80% of logs into China were sourced from New Zealand, Europe and Latin America. European supply represented a third of inbound logs into China with Germany becoming the second largest supplier only behind New Zealand.

CHILE — On December 19th, Chileans held presidential elections with a historically high participation rate of more than eight million Chileans (55.6% of eligible voters). Gabriel Boric (center-left) defeated Jose Antonio Kast (center-right) by winning 55.87% of the votes. The parliament, with the chambers of deputies and senators, remained in balance between left and right representatives which suggest that the coming period will be one in which favorable agreements for the country should be sought and negotiated for the approval of new laws.

Chile continued to successfully manage the pandemic with one of the highest vaccination rates in the world. This has allowed the country to generally return to normal operation, although cautiously monitoring slowly increasing infection rates due to the arrival of new variants.

The Central Bank of Chile’s most recent economic forecast for 2021 improved to a range of 11.5% to 12.0% thanks to greater dynamism in spending, with important upward adjustments in private consumption and capital investment in equipment and machinery. But as with the rest of the world, in Chile inflation has also become a point of concern, registering a 7.2% annual increase, the highest reading in fourteen years.

During November (latest data available) forest product exports from Chile rose to $592 million USD. This represents a 17.9% increase from the previous month and the highest record of the year. It is 42% higher versus November 2020. One of the main drivers for robust exports has been sales of bleached eucalyptus pulp (BEK) which grew by 54.8% as well as solid moldings which grew by 44.6%. Year-to-date exports through November of $5,371 million USD were 19.4% higher than the same period in 2020. China continued to be Chile’s most important destination for forest products with a 33% share, followed by the United States with 22% which has increased its appetite for Chilean manufactured forest products.

BRAZIL — During the fourth quarter of 2021, 68% of Brazilians had received full vaccination against COVID 19, and 78.4% received at least one shot. Booster shots are now being applied across the country. Yet through the new year the arrival of the Omicron variant into the country has been the driver of a meaningful increase in cases and local governments are still assessing its potential impact to the health system since hospitalization rates remain low. Daily new cases (seven-day average) have increased to 33,000 from 15,000 versus the end of the previous quarter.

Economic activity, which had been on a positive trend throughout the year, decelerated during the fourth quarter, with full year expectations of 4.6% growth. With inflation at 10.4% by end of year, Brazil’s COPOM moved strongly to prevent any further deterioration, raising interest rates by three hundred basis points to 9.25%. It also signaled potential further rate hikes up to 11.5% as it targets bringing inflation back down to levels of 5.0% during 2022.

In the forest sector pulp production in Brazil expanded by 7.2% year-to-date through September (latest data available) versus the same period last year. Similarly, during the same period, domestic consumption of wood panels and exports also rose by 22.3% and 6.7% respectively. Through the end of the year and start of 2022 net hardwood and softwood prices for pulp in China showed positive momentum opening a door for additional 20-30 USD/ton increases to be possibly announced by Suzano and Klabin in the short term. Expected maintenance stoppages in Brazil could also temporarily remove up to two hundred and thirty thousand tons of pulp capacity from the market.

![]()

HOUSING — U.S. homebuilding surged nearly 12% to an eight-month high in November, to a seasonally adjusted annual rate of 1.679 million units.

MORTGAGE RATES — Rates have inched up from their historical lows, to approximately 3.25% as of early January. That is up from an average 30-year rate of 2.65% in January 2020, the lowest on record.

JOBS — The jobs report came in for December at 199,000, less than half the amount predicted by economists. Yet over 2021, an average of 537,000 jobs were created each month, with considerable volatility in the monthly readings. The unemployment rate fell from 6.3% in January to 3.9% at year’s end.

CONSUMER CONFIDENCE — The consumer confidence index rose to 115.8 in December, up slightly from November, suggesting the economy would continue to expand in 2022 despite a resurgence in COVID-19 infections and reduced fiscal stimulus.

INFLATION — The Consumer Price Index shot up to 6.8 percent by the end of 2021, the highest it’s been in 40 years.

TRADE DEFICIT — The U.S. trade deficit surged to a near-record high of $80.2 billion in November as exports slowed while imports jumped sharply. The November deficit was 19.3% higher than the October deficit of $67.2 billion and was just below the all-time monthly record of $81.4 billion set in September.

INTEREST RATES — Minutes of the December Federal Reserve Open Market Committee meeting showed deliberations to lift short-term rates “sooner or at a faster pace than participants had earlier anticipated.” Treasury yields as of early January were as high as 1.71%.

OIL PRICES — Prices moved up over the quarter, hitting levels of around $80 per barrel as of early January, reflecting a recovering economy as well as the risk of supply chain disruptions with certain OPEC members.

U.S. DOLLAR — The U.S. dollar index, which measures the currency against six major peers, stood at a level around 96 as of early January.

![]()